JLP (Jupiter)

JLP

Target Name

JLP (Jupiter)

Ticker

JLP

Strategy

long

Position Type

token

Current Price (USD)

-

Circulating Market Cap ($M)

-

Fully Diluted Market Cap ($M)

-

CoinGecko

JLP long

24 Aug 2024, 11:37am

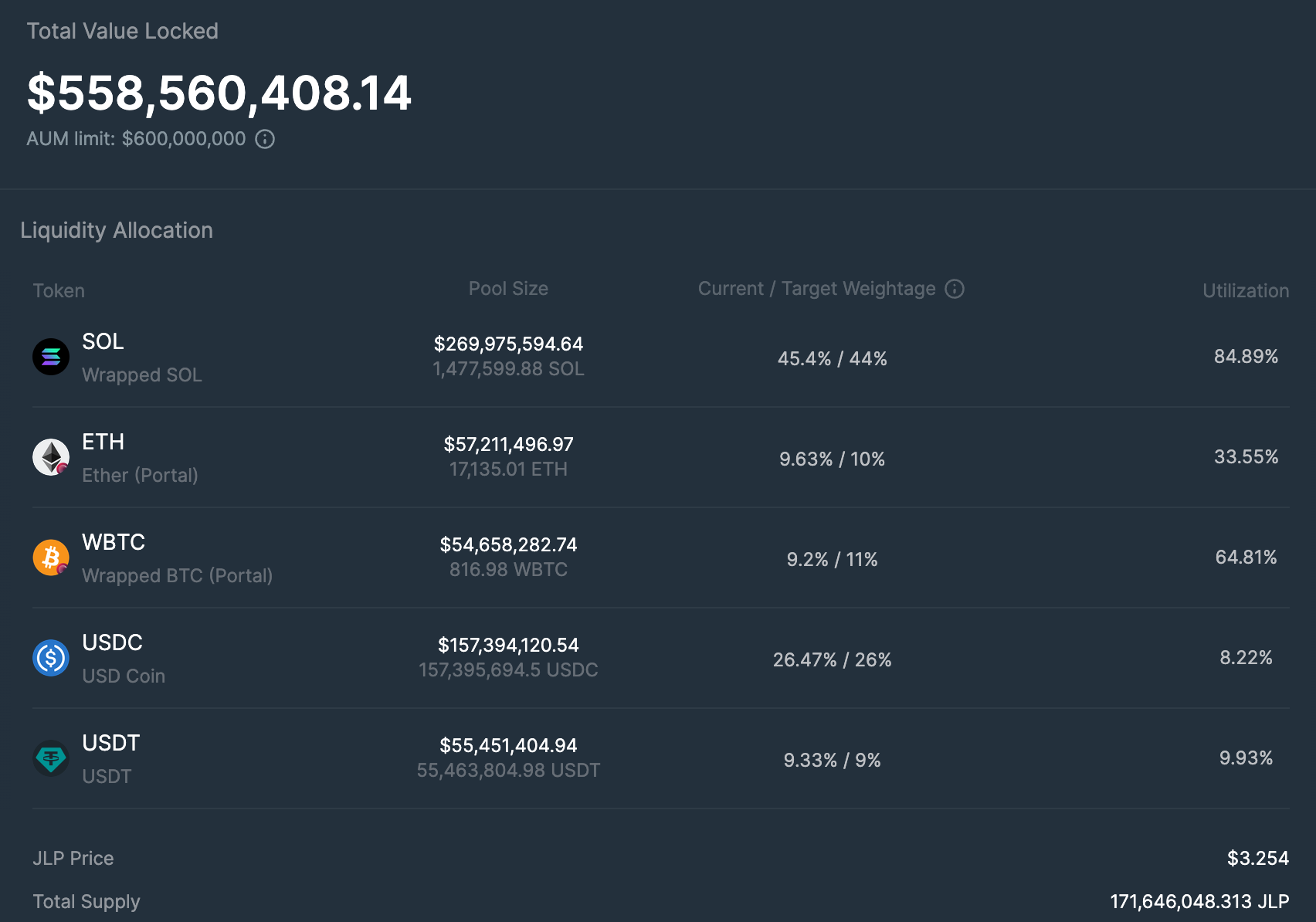

JLP is a structured product from the Jupiter exchange on Solana. Among other things, Jupiter offers perpetual futures trading on BTC, ETH, and SOL with up to 100x leverage, and JLP acts as the liquidity and counterparty to these traders. JLP is made up of a basket of assets.

For every $1 of JLP bought, you are effectively buying:

$0.454 SOL

$0.0963 ETH

$0.092 BTC

$0.2647 USDC

$0.0933 USDT

The price of JLP is, therefore, first and foremost a function of the prices of the underlying assets. If BTC, SOL, and ETH appreciate, so does JLP, but less since it contains ~35% stablecoins, and vice versa. More specifically, the price of JLP is a function of three things:

The price of the underlying assets (BTC, ETH, SOL, USDC, and USDT)

Fees paid by traders

Trader PnL

75% of all fees generated by traders on Jupiter perps go to the JLP vault. This equates to a 50% APY at current fee levels and is accrued via JLP price appreciation. Finally, JLP acts as the counterparty to traders on Jupiter. If a trader is profitable, the gain is paid out from the JLP vault, and if a trader is unprofitable, the loss is added to the vault. The chart below shows the price of JLP since the beginning of the year.

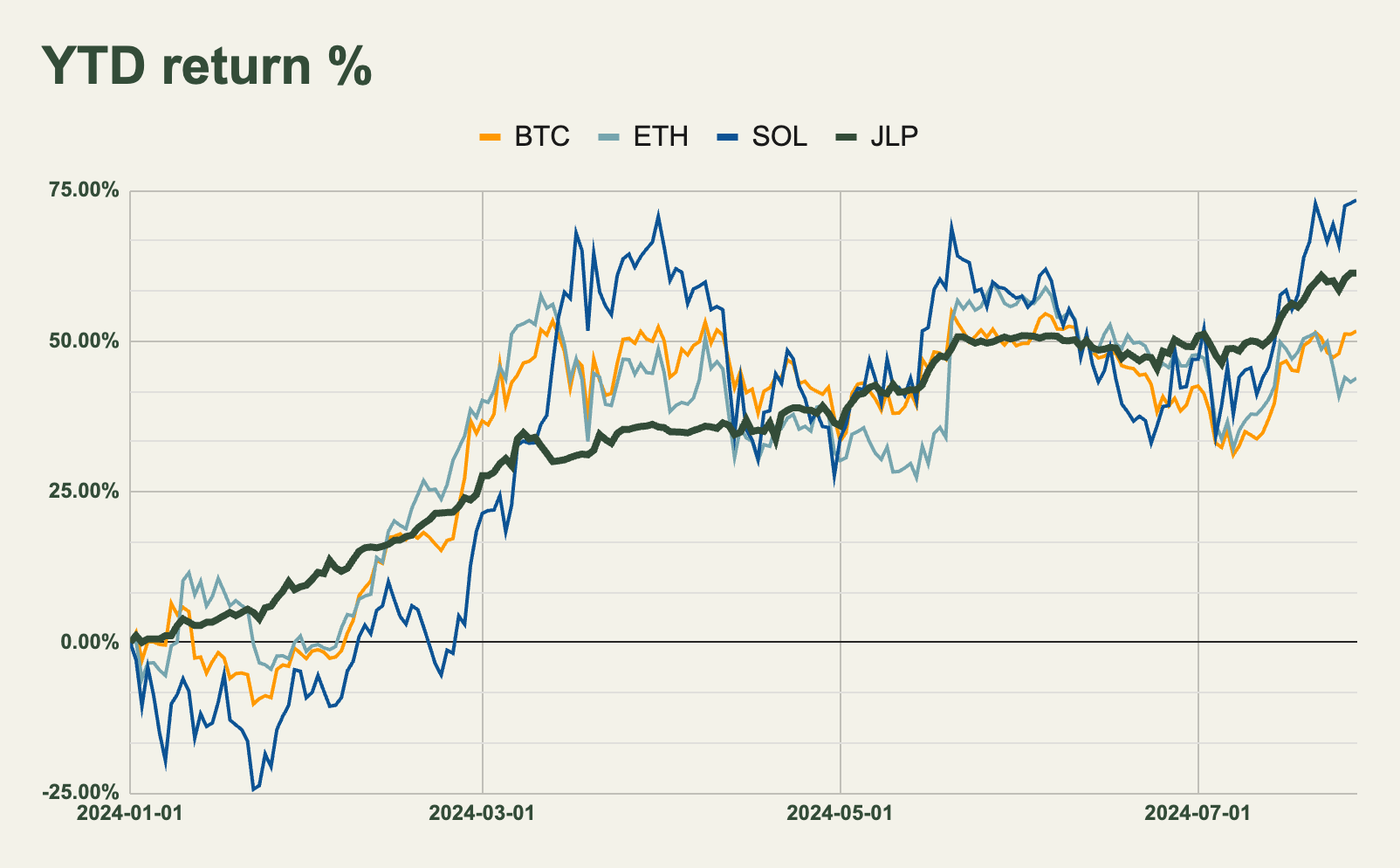

Notably, JLP is up from $1.78 to $3.25 this year alone as a function of underlying assets having appreciated and a lot of fees collected by traders. This is a 61.28% gain with very modest drawdowns, resembling a nearly up-only chart. A 61.28% ROI YTD is equivalent to a 106.5% APY, which far outperforms any sort of stablecoin product. Comparing this to a stablecoin strategy is, however, somewhat dishonest as JLP only contains a 35% stablecoin composition. Holding JLP versus farming with a stablecoin entails taking on more risk (e.g., trader PnL exposure) and volatility from the underlying assets.

But what about JLP performance versus BTC, ETH, and SOL? As the chart below depicts, JLP has outperformed both BTC and ETH, but not SOL year-to-date.

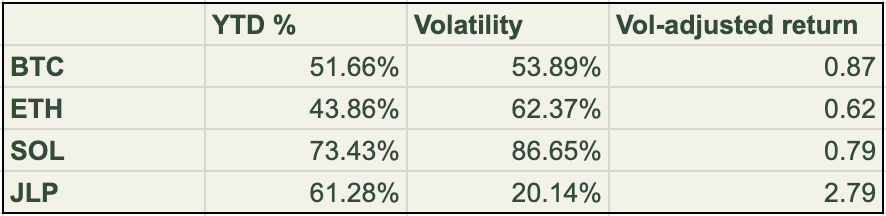

Further, we can compare the JLP return with BTC, ETH, and SOL on a volatility (risk) adjusted basis.

As the table depicts, JLP is a far less volatile investment compared to just holding BTC, ETH, or SOL, and has therefore significantly outperformed on a vol-adjusted basis YTD.

Volatility-adjusted returns are not the same as risk-adjusted returns, however, as JLP contains more risk vectors than simply its volatility. When holding JLP, you are exposed to smart contract risks, and the price could also be affected negatively if traders become highly profitable (partially draining the JLP vault). As there are no long-tail assets to be traded on Jupiter, the risk of price manipulation is small, and an incident like what happened with AVAX, where GLP was partially drained back in the day, is of low probability.

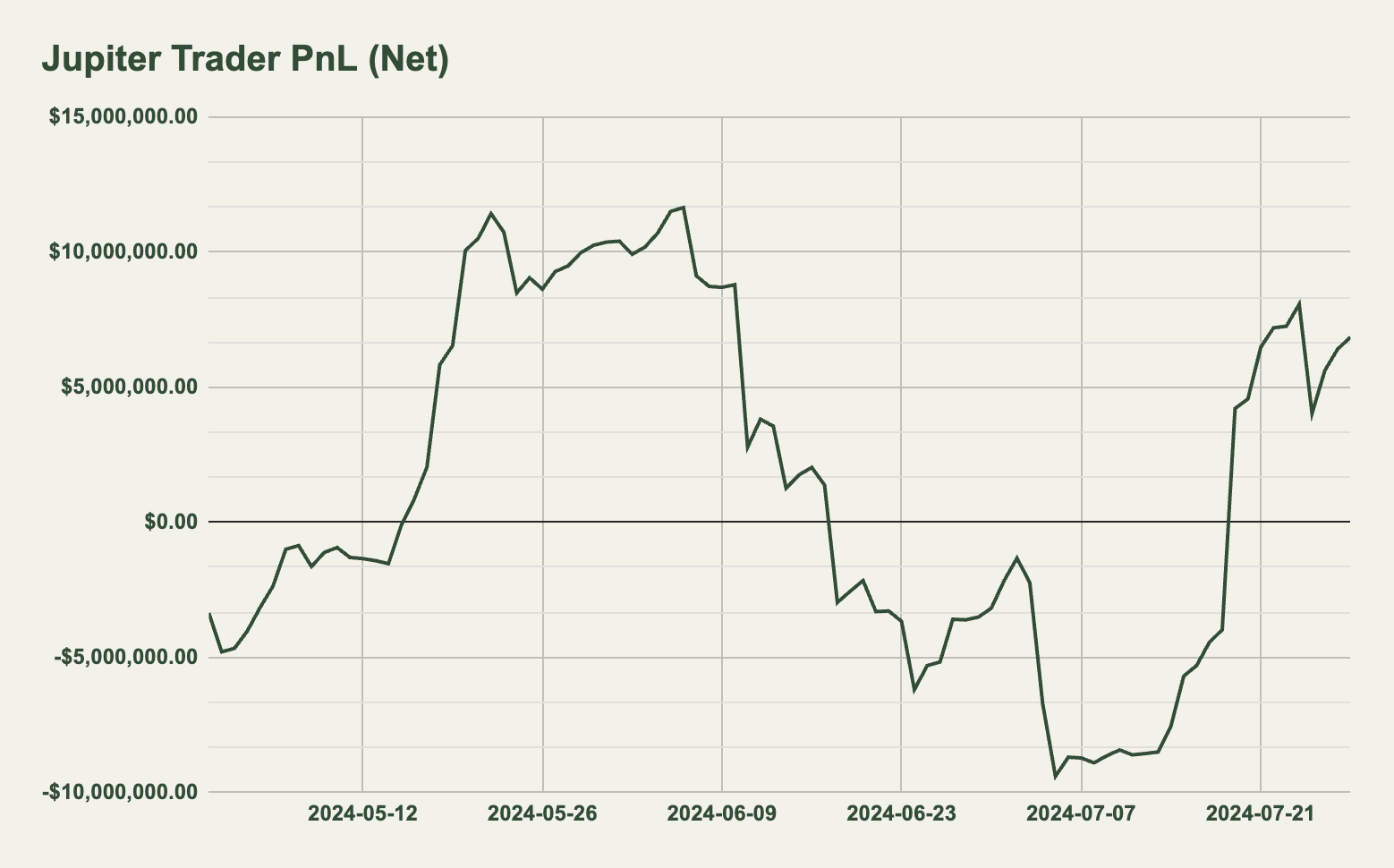

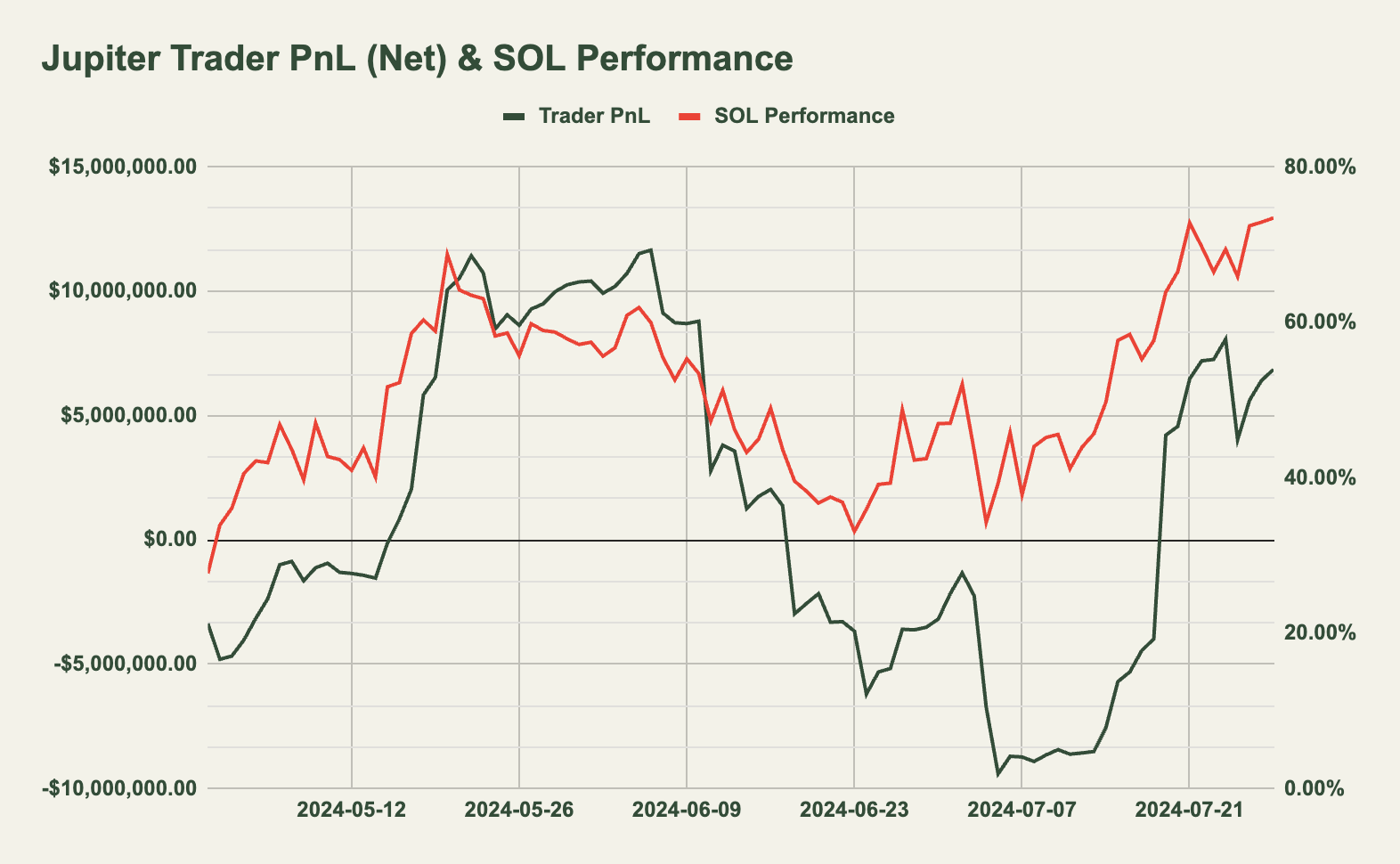

Nonetheless, we can examine the aggregate trader performance on Jupiter to try and quantify the JLP counterparty risk. The chart below shows the Jupiter net trader PnL over the past three months.

Notably, traders have been net profitable in the past three months with a cumulative gain of $6.85 million. This effectively means that $6.85 million of the JLP vault has been paid out to traders, impacting its performance negatively. Despite this, JLP has been a strong performer due to the high fees paid by traders simultaneously.

What's further interesting is that there seems to be a high correlation between the cumulative trader PnL on Jupiter and the price of SOL, as seen below.

This indicates that SOL is the most traded asset on the Jupiter perps, which is confirmed by the 24-hour volume being $139 million for BTC, $80 million for ETH, and $633 million for SOL (74.3% of all volume). At the same time, it also indicates that the open interest is skewed to the long side, i.e., most traders are long rather than short.

To sum up, in a scenario where SOL absolutely rips, traders could be profitable, which impacts the JLP price negatively. At the same time, however, SOL appreciating impacts JLP positively, so there's somewhat of a hedge.

•

•

•

Affiliate Disclosures

- The author and/or others the author advises do not currently hold, or plan to initiate, an investment position in target.

- The author does not hold an affiliated position with the target such as employment, directorship, or consultancy.

- The author is not being compensated in any form by the target in relation to this research.

- To the best of the author’s knowledge, the information provided here contains no material, non-public information. The accuracy of the information is the responsibility of the reader.

Neither BIDCLUB nor PHATPITCH LLC represents or endorses the accuracy or reliability of any advice, opinion, statement or other information displayed, uploaded, or distributed through BIDCLUB by any user, information provider, or other party. PHATPITCH LLC is not a broker, a dealer, or investment adviser. Nothing in BIDCLUB constitutes an offer or a solicitation to buy or sell any securities. BIDCLUB prohibits the sharing of material non-public information (MNPI), but assumes no responsibility for member conduct or associated risks. Nothing in BIDCLUB is intended as specific investment advice and no individual should make any investment decision based on any recommendation or analysis provided on BIDCLUB. You acknowledge that any reliance upon any such opinion, advice, statement, memorandum, or information shall be at your sole risk, and you bear sole responsibility for your own research and investment decisions. See full

Terms and Conditions.

It would be helpful to decompose JLP's return profile into its index constituents + fee yield, because that's the real math (GMX does this in their public dashboard). What does that look like?

What has fee yield looked like over time?

Are there products to hedge out the underlying if one wanted (or "hedge long" the stablecoin piece), as there exist on Arbitrum for GMX?