Uniswap

UNI

Target Name

Uniswap

Ticker

UNI

Strategy

long

Position Type

token

Current Price (USD)

6.69

Circulating Market Cap ($M)

-

Fully Diluted Market Cap ($M)

-

CoinGecko

Be a Midcurve and Buy UNI ahead of the Fee Switch

22 Sep 2024, 12:41am

TLDR summary

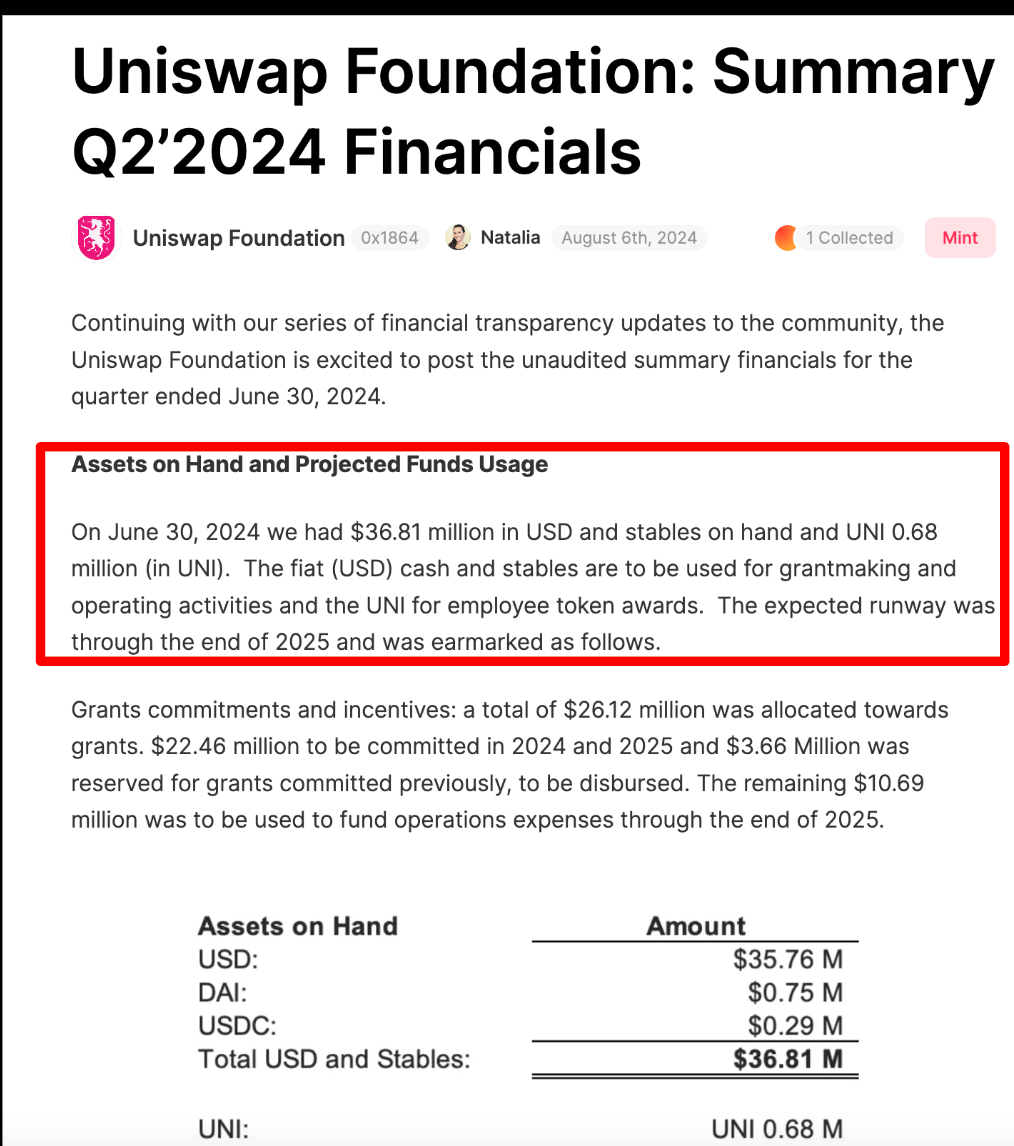

Uniswap Foundation is poor (runway until 2025). Fee switch must happen to pay themselves.

a16z has been posting a bunch of shit around compliant ways to turn on a fee switch

No one owns this shit

For a more serious analysis of Uniswap, check out my thread or my video. Also check out my AAVE thesis back in July 2024 in my thread or video for more context of my meme, “DeFi Renaissance.”

The Uniswap Fee Switch

When the Uniswap Foundation tried to turn on the fee switch in February, the thing went from $6 to $17. So clearly the market will buy this thing if there’s any promise of future value accrual. Unfortunately, a16z stepped in to postpone the proposal in May. As a result, UNI has retraced all its gains and the market has ignored it as a VC coin that doesn’t care about the token.

Then in August 8, a16z wrote an entire piece about how to generate cashflows for app tokens.

According to a16z, there are 3 ways to drive cash flows to app tokens in a compliant way: 1) Allow staking for certain jurisdictions 2) Reward behavior (fees go to delegators) 3) Create an appchain/L2. I’d like to first focus on the DUNA that’s laid out by Miles Jennings, one of the authors of the a16z article.

He mentions DUNA, and I’m like “wtf is that.” So I decided to dig. Apparently DUNA was signed into law on July 1, 2024. So perhaps a16z advised the Uniswap Foundation to delay the fee switch until then? Note, the fee switch proposal was about to be voted on May 31, 2024.

Idk jack shit about regulation because I’m 100iq but apparently under the DUNA legal entity form will strengthen the argument that crypto assets aren’t securities.

So basically, it looks like a16z has laid out a compliant way to turn on a fee switch for app tokens. Idk their portfolio but it’s not a reach to assume that Uniswap is a prime candidate for this.

Another potential catalyst is UNIchain (thoughts laid out below):

The timeline seems… interesting to say the least.

The $UNI Trade

Risk/reward is favorable. Everyone hates this asset but we’ve seen it pump on the February fee switch proposal. If another one happens soon (or a chain/L2) then surely this shit’s going to >$20. You probably think I’m redacted. That’s good. That means you don’t own it. No one does.

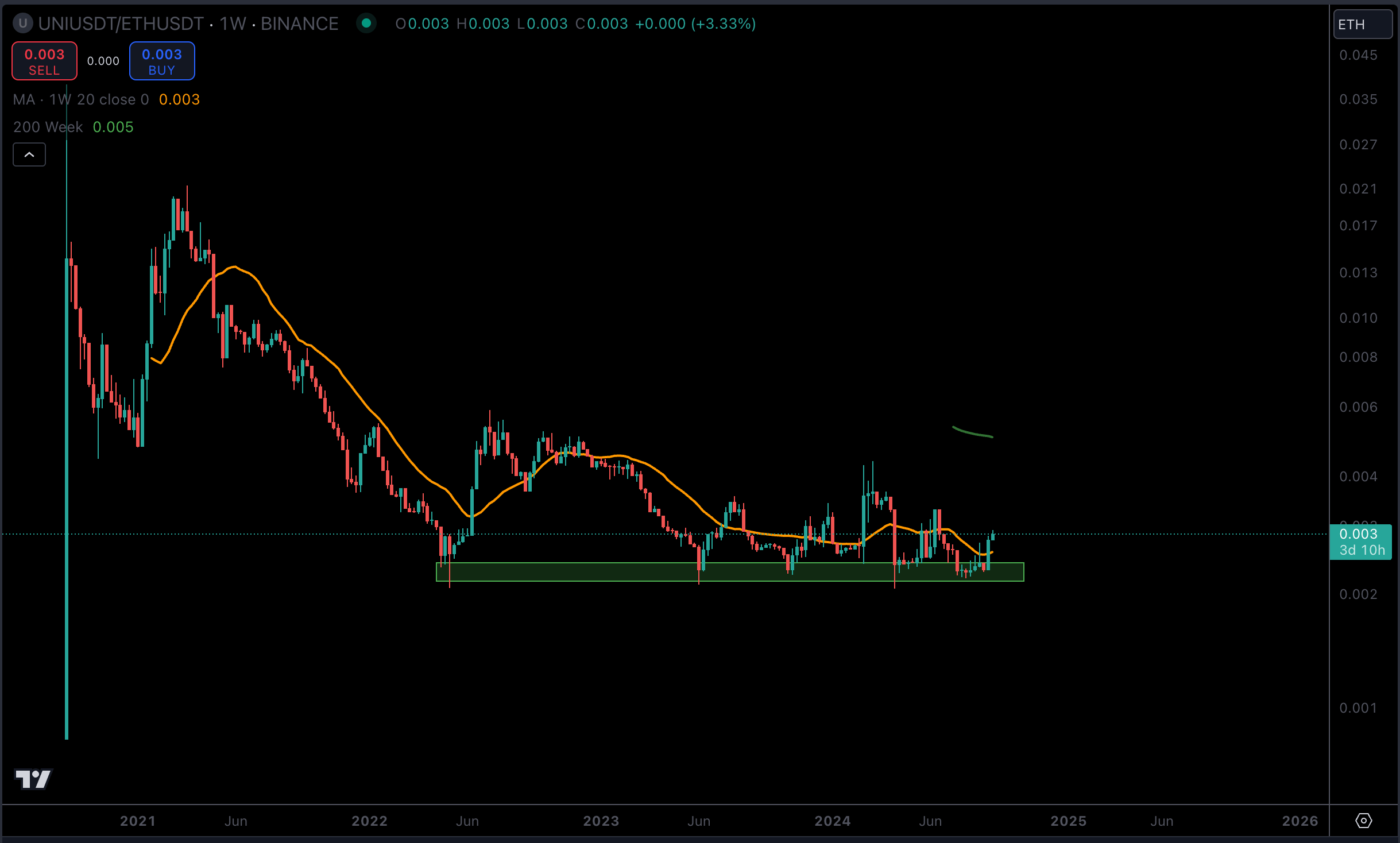

ETH is cucked but UNI/ETH is bottoming?

Lastly, Uniswap Foundation is poor. They need to turn on a fee switch at some point so they can fund themselves.

Summary

Chances are, when you saw this report on Bidclub.io you probably thought I was redacted. This is good. This is how the market has been conditioned to think about this asset. However, it’s clear that Uniswap is a category leader with incredible pricing power given it is the “front-end” of EVM DeFi. Everyone agrees Uniswap is an amazing company, but a bad token. But if the token becomes less bad, I suspect significant inflows into this asset (February 2024 pump as an example).

I believe the market has swung too hard towards the “financial nihilism” pendulum, and the logical next step is for the market to care about fundamentals again. DeFi has clear PMF and is coming out of the “trough of disillusionment.” The problem with new tokens is that you have to consider the supply and demand side. For most of these OG DeFi tokens, the supply is in strong hands. So if I can predict potential demand catalysts, I can make a lot of money.

Fear not my friends, DeFi will be great again.

Addressing some of your potential questions:

Q: How do you feel about Hayden's long-term executional power?

A: He's balding. This is very bullish. A bald head is a pre-requisite to run a successful exchange (CZ, Brian Armstrong, etc). This is another catalyst the market is not considering.

Q: What yield can UNI stakers expect?

According to a report by Gauntlet, you can see the rough estimates of potential revenues below:

“Using our predictions of trading volumes at various protocol fees we are able to predict the amount of revenue generated. For revenue projections estimates we use the 3 month period from August 2023 to January 2024 as a reference lower bound and December 2021 as a reference upper bound for volume on Uniswap, assuming that the protocol fee is restricted to pools on the Uniswap Labs whitelist. We can consider 3 fee scenarios to illustrate the mechanics of the tradeoff, noting that these are chosen to highlight significant inflection points and are not necessarily practical options for Uniswap.

Conservative (10% Protocol Fee) - A 10% protocol fee on the currently whitelisted pools would generate an expected $10.3M-$40M of annualized revenue.

Flywheel Avoidant (20% Protocol Fee) - We find that the flywheel effect of reduced volume driving reduced liquidity only kicks in significantly at an ~20% protocol fee. Here we would expect to see about $19M-$72M in annualized revenue.

Profit Maximizing (60% Protocol Fee) - Taking the effect of negative volume-liquidity flywheels into account we would expect to maximize protocol revenue at a 60% protocol fee driving an expected ~$43M-$160M in revenue. Note that a protocol fee this high is not supported by Uniswap V3, so this scenario is theoretical.”

This, of course, does not take into account potential revenues from UniV4 hooks (I.e. The Uniswap Foundation can ship DCA/limit orders and monetize those features, similar to Jupiter). But by traditional P/E terms, $UNI is not “cheap” by any means.

I have given this a lot of thought but I don’t really think the yield matters. I think what’s most important is the psychological effects the fee switch will have on capital allocators in the space. Many view DeFi tokens as “uninvestable worthless governance tokens,” and they have been right historically. However, after a potential fee switch everyone must have an opinion of these tokens which will lead to more attention (and therefore inflows) into category leaders in DeFi (such as my AAVE thesis).

All the Mag 7 stocks have a dividend yield of <1% but they’ve outperformed the majority of stocks given they are category leaders with growing earnings & market share. Similarly, I think UNI can become a top 10 crypto asset even if the “real yield” is <1%.

In the case Uniswap creates their own chain (where they can capture MEV and validator fees, the path to top 10 is pretty clear).

Q: Timeline for Uniswap V4?

V4 audits by firms have concluded, and there is one final bug bounty program that will end Oct 1. I expect V4 to launch Oct/Nov. Since Uniswap Labs is working on V4 and the Foundation is doing anything governance-related, these things might not be announced/launched at once. The uncertainty is there but I believe it’s already in the price.

•

•

•

Affiliate Disclosures

- The author and/or others the author advises do not currently hold, or plan to initiate, an investment position in target.

- The author does not hold an affiliated position with the target such as employment, directorship, or consultancy.

- The author is not being compensated in any form by the target in relation to this research.

- To the best of the author’s knowledge, the information provided here contains no material, non-public information. The accuracy of the information is the responsibility of the reader.

Neither BIDCLUB nor PHATPITCH LLC represents or endorses the accuracy or reliability of any advice, opinion, statement or other information displayed, uploaded, or distributed through BIDCLUB by any user, information provider, or other party. PHATPITCH LLC is not a broker, a dealer, or investment adviser. Nothing in BIDCLUB constitutes an offer or a solicitation to buy or sell any securities. BIDCLUB prohibits the sharing of material non-public information (MNPI), but assumes no responsibility for member conduct or associated risks. Nothing in BIDCLUB is intended as specific investment advice and no individual should make any investment decision based on any recommendation or analysis provided on BIDCLUB. You acknowledge that any reliance upon any such opinion, advice, statement, memorandum, or information shall be at your sole risk, and you bear sole responsibility for your own research and investment decisions. See full

Terms and Conditions.