Shuffle

SHFL

Target Name

Shuffle

Ticker

SHFL

Strategy

long

Position Type

token

Current Price (USD)

0.38

Circulating Market Cap ($M)

39,611,818

Fully Diluted Market Cap ($M)

368,759,543

CoinGecko

Shuffle - Product Market Fit No One Talks About

08 Oct 2024, 05:20am

TLDR:

Shuffle trades at 52.9M MC / 314.3M FDMC (as of 1 Oct); Does 14bn volume and 100mm in revenue annualized; it’s trading at 0.5x earnings MC wise, and 3x earnings FDMC wise.

It’s building a world-class product and onboarding at a massive pace (1 year since launch and has reached audiences worldwide) ; has an amazing growth story

At the time of writing (0.38~) cents, it’s extremely undervalued with favourable tokenomics despite the massive FDV overhang; and has incredible PMF similar to the likes of Polymarket / Hyperliquid / Pumpdotfun as a product (Casino, Gambling)

Heralded as products with the most product market fit thus far, Polymarket, Hyperliquid and Pumpdotfun have taken the crypto world by storm as VCs and thought leaders relentlessly talk about how the trio are “the best products this cycle”. You don’t have to look far under the hood to see that they’re all united by one desire: Speculation.

It’s funny, because people will dunk on crypto having “no use case aside from speculation”, but celebrate when said speculation is packaged into a product for people to use that engages thousands, if not millions worldwide. Memecoin = bad. Launchpad that enables you to launch gazillions of memecoins? AMAZING.

Let’s be clear: I’m not dunking on any of these products. Quite the opposite, in fact. I simply believe that speculation IS the product, and there’s nothing wrong with admitting that. The idea that speculation isn’t a use-case is ridiculous, considering that half the financial system is built on the idea of “outperforming the markets”, which implies price going higher. From trading to business acquisitions, many things are based upon the simple “sell to a higher bidder”. It’s no surprise that crypto, the most speculative asset class, found its most-used product to be a perp DEX, prediction market, and a memecoin launchpad!

But I digress. I believe that a new addition to the trinity is in order - a Casino. Done well, casinos are venues that do incredible amounts of volume while making absurd amounts of profit through house edge. “The house always wins”, as the saying goes. Despite people knowing that gambling is -EV in the long-run, millions still flock to casinos just to click a shiny green/red button, and the house wins because over the long run, more players lose than they win. (sounds familiar? the memecoin “casino” is similar, with arguably much worse edge)

And now, enter Shuffle: A world class casino that is showing insane growth, making incredible margins, and looks to be an extremely undervalued product.

Thesis

1. Shuffle is building an amazing product

Crypto casinos often get dunked on because of two reasons:

They tend to rely heavily on crypto-specific liquidity, which is typically short-term and lacks stickiness

They try to build decentralized casinos, which are historically hard to build due to their technicalities. Instead, casinos but with a token would be much better suited to crypto (think Binance with BNB, or Hyperliquid with their token)

In my view, crypto casinos should prioritize the core casino experience first and crypto integration second. - this means avoiding the complex task of decentralizing gambling - just like how some perp-DEXes don’t try to solve the problem of a decentralized orderbook. Instead, they focus on building a normal casino, with a crypto twist.

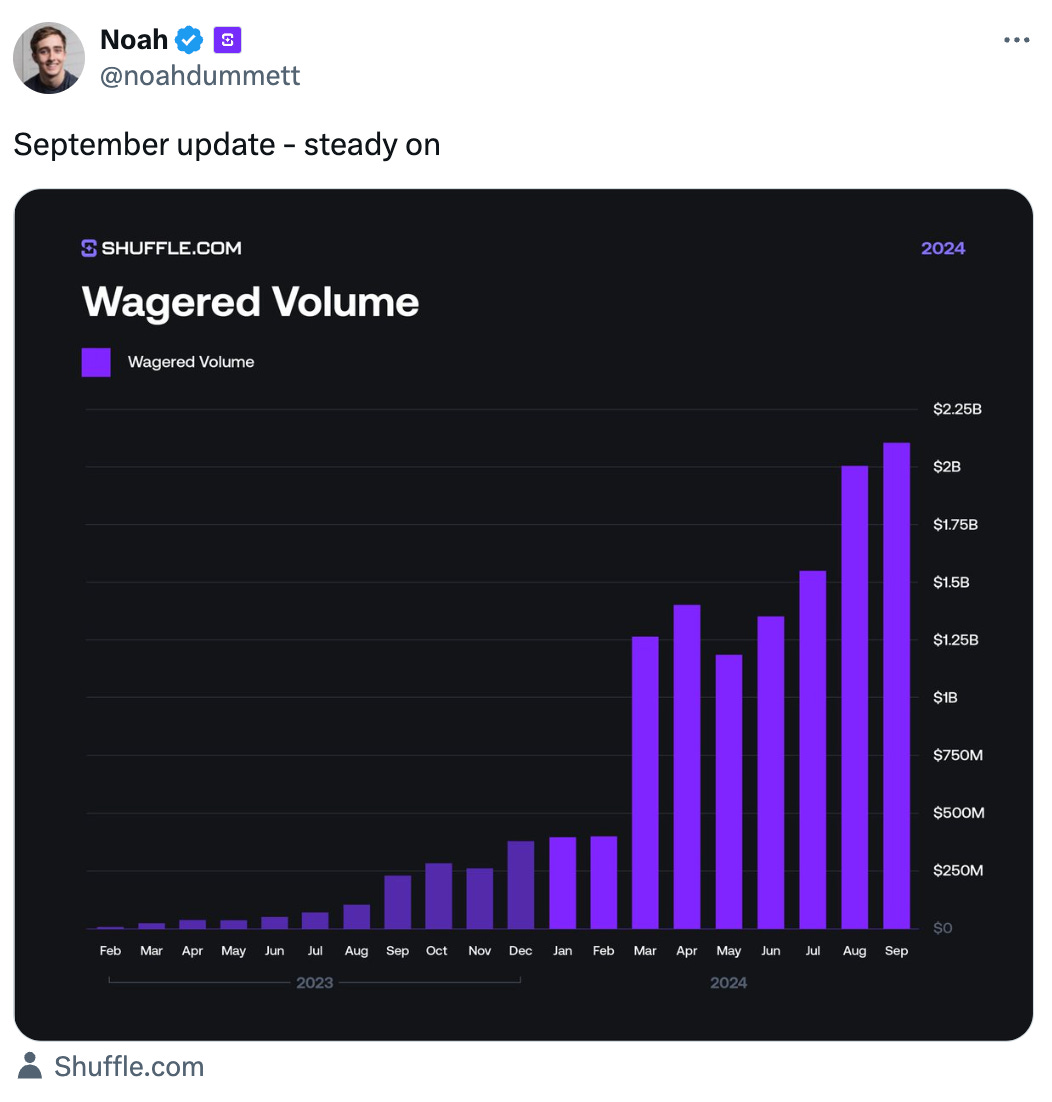

That’s exactly what Shuffle does. While Shuffle has a token (and is very focused on bringing utility to said token), it started out purely as an online casino in the bear market of February 2023, and since then they’ve managed to achieve over $2 billion in monthly wager volume.

This bear-to-bull market anti-fragility is, in my opinion, a key factor in their proof of being a great product. If you build in a bear market and still manage to attract users, I believe that you’re making something great and have some sort of product-market fit ; It suggests that people are drawn to your platform, regardless of market conditions.

It also helps that Shuffle pivoted from their original idea of attracting crypto-whales to their platform - as Noah (Founder Of Shuffle) mentioned in a podcast, they halted that idea once they realised it wouldn’t work in the long term.

“Most users of Shuffle are not crypto users, but users who just happen to use crypto to gamble” - Noah (Paraphrased from podcast)

This shift was crucial in attracting users who are genuinely interested in the product itself, rather than those who are simply farming rewards. Crypto liquidity is often mercenary, and appealing to these users typically results in a volatile "M"-shaped chart, as they ride the speculative wave but rarely stick around.

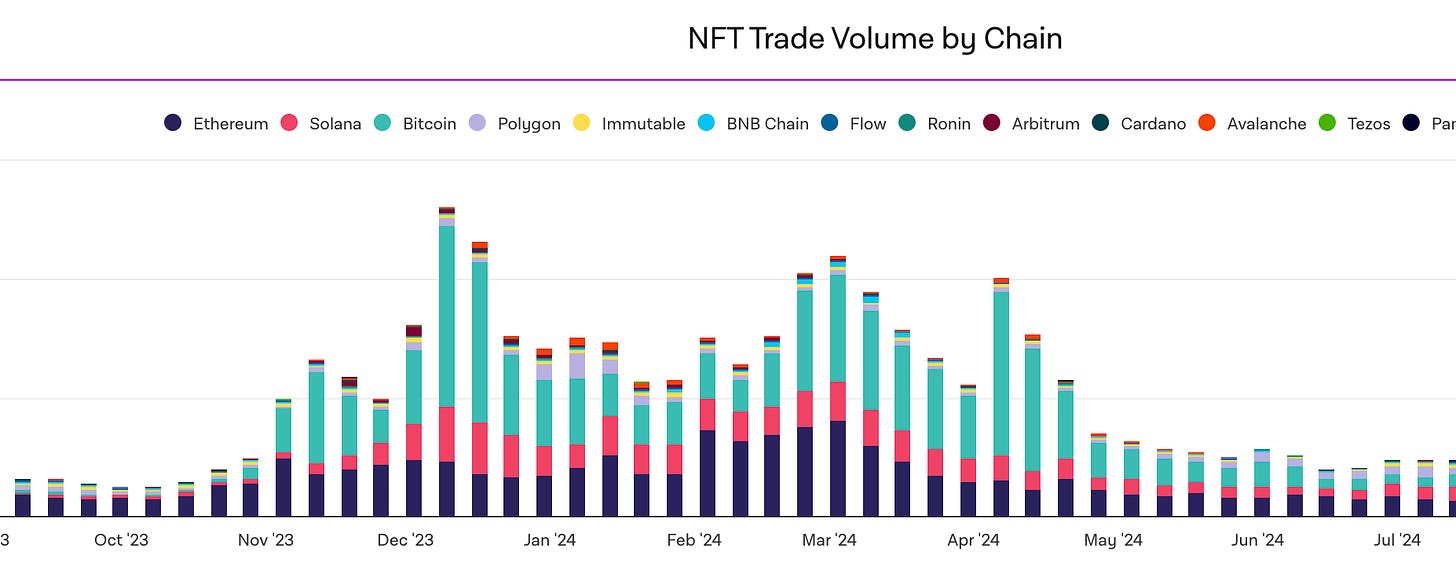

Case in point: NFT volumes. Typical M pattern that mark peak of speculation, with no real lasting liquidity

And so the combination of 1) launching during the bear and 2) not choosing to cater to crypto whales means that most of the people that come to Shuffle, genuinely like the platform and will stick - i.e a durable moat. The result is a gradual MoM ramp-up of volume, signalling actual growth.

And if you want to argue that the sharp jump in volume was “because of the airdrop” - post Airdrop 1 (AD1) we still saw continued growth; They didn’t have the usual post-airdrop dump in volumes, which is yet another bullish indicator that they’ve truly built a product that people use.

2. Shuffle makes a ton of money, and has excellent value accrual

“SHFL will be tightly integrated with the core platform, reward the most active users, build the community, and take the player experience to new heights. The token is designed to grow alongside the platform, with SHFL being the best token to wager with on Shuffle.” - Shuffle Docs

If building a great product wasn’t hard enough, building a fantastic token is even harder - most products fail at one, and succeed at the other. Take UNI, dYdX or Lido for example - these are all great businesses, with terrible tokenomics / value-accrual to the token.

Shuffle, on the other-hand, has made it clear that their token is instrumental in its capabilities as a casino, and that as they aim to be the best casino in the world, the token should grow along with them.

So far, Shuffle has two main ways of accruing value to the token:

Wagering in SHFL

Users can use SHFL to wager - this Shuffle is sent to the treasury and removed from the circulating supply. Users can swap their assets to SHFL in-app, and wagering with SHFL gets you bonuses and benefits. Basically, it’s pretty similar to what Binance does with BNB - by offering benefits of doing X with SHFL instead of usual fiat, users are persuaded to sell their fiat / collateral, buy SHFL, and wager in it instead.

Buy-back and burns (BB&B)

Creds to Lai Yuen!

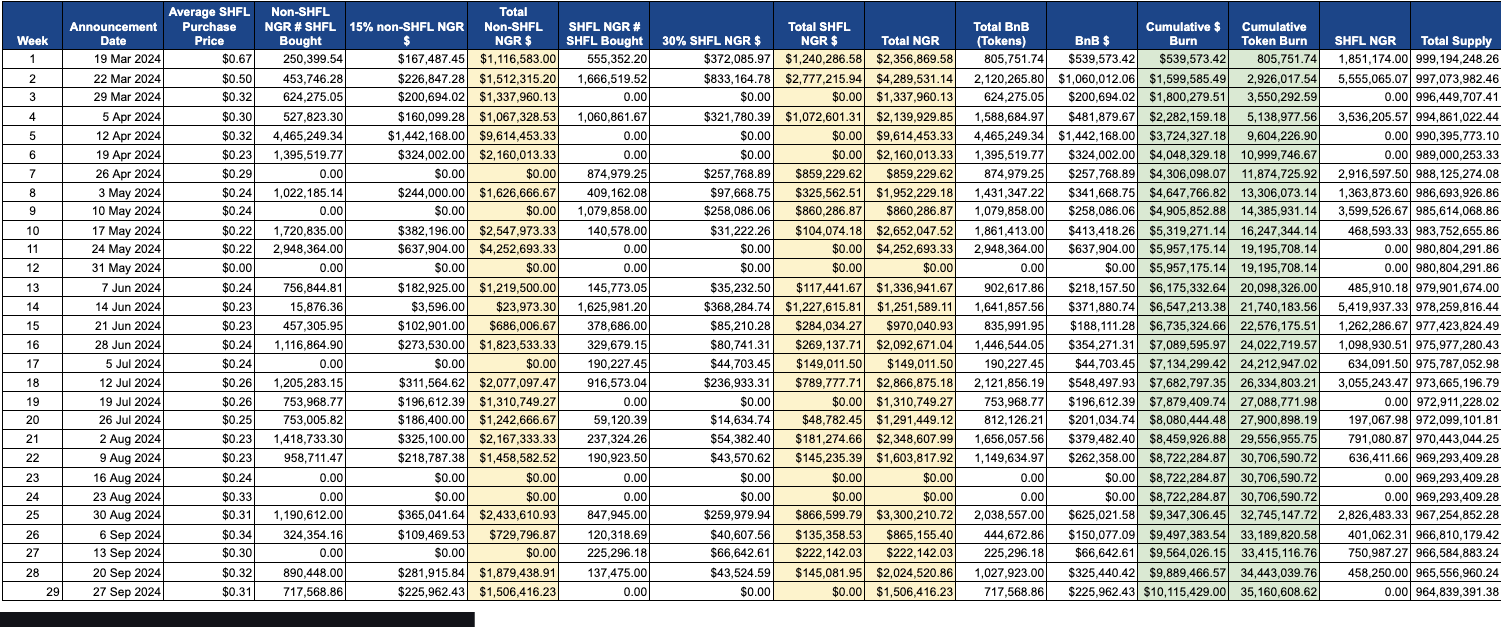

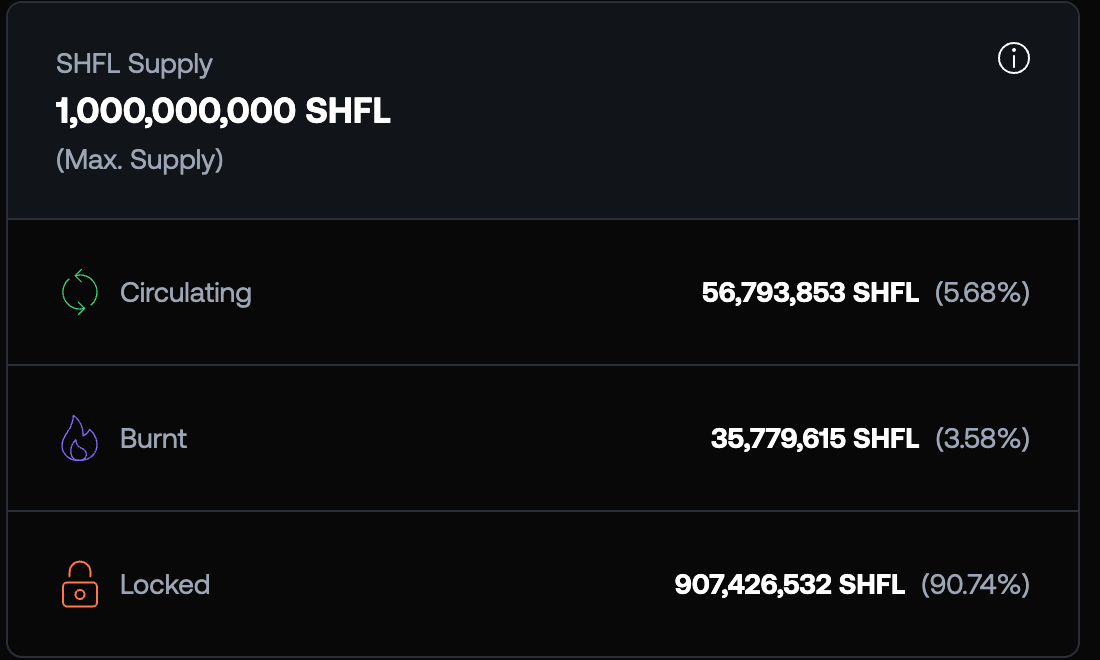

BB&B’s are probably the most commonly-used way to drive value to the token - and Shuffle does it too. So far, they’ve burnt 3.58% of total Shuffle - my criticism here is that buy-back and burns typically don’t impact the markets until much, much later - however, Shuffle’s buy-back and burns are useful in gauging how much they make.

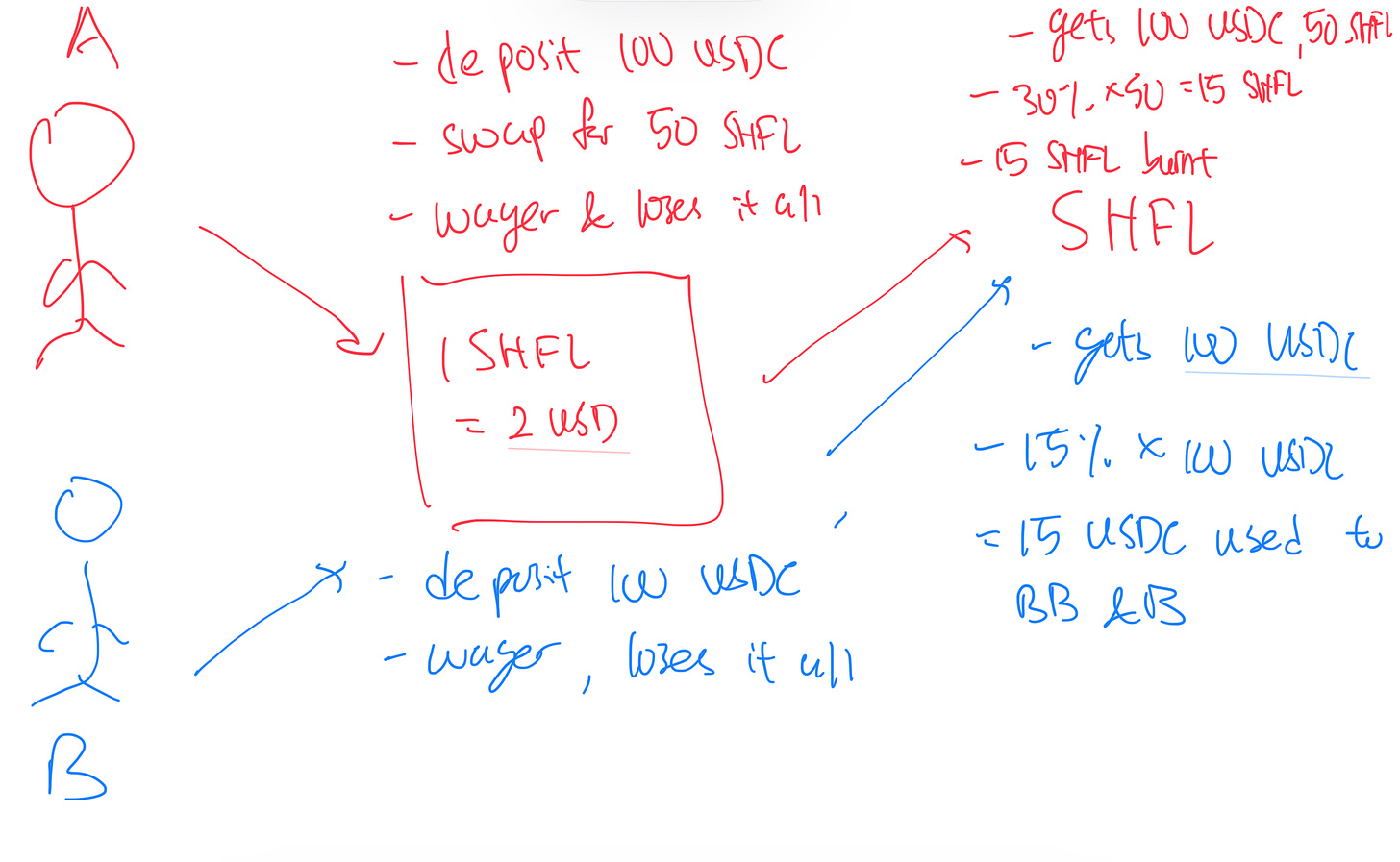

15% of non-SHFL net gaming revenue (NGR) and 30% of SHFL NGR are used to BB&B SHFL tokens on a weekly basis. Here’s a useful illustration of how it works:

While some might think that using SHFL to buy-back and burn SHFL is shady, my pushback is that the fact remains that the casino still makes money on the swap. Money in a system cannot be created or destroyed, only transmuted. When someone sells USDC for Shuffle, that amount is still being used to “buy” SHFL, and all the casino has to do is to burn a 30% stake.

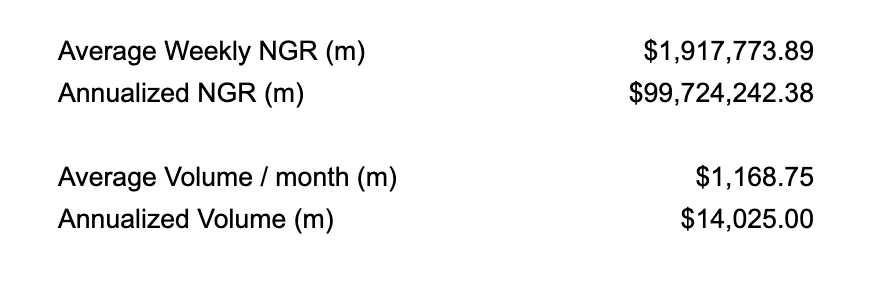

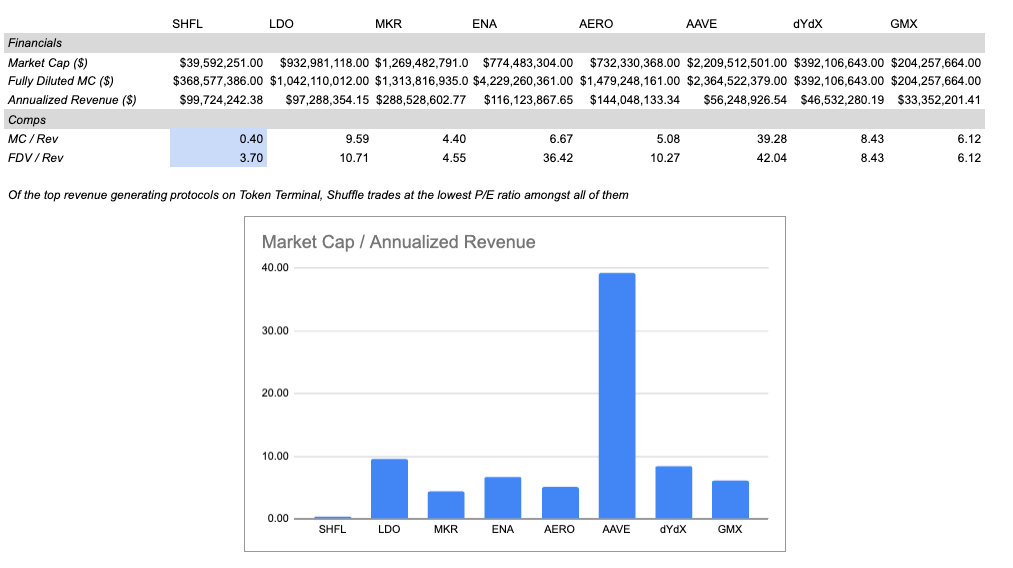

Now let’s breakdown the BB&B data. It’s really simple, actually - the data shows that Average Weekly NGR = 1.917mm ; Annualized NGR is thus = 100mm~; When comped against the top revenue generating protocols on Token Terminal, Shuffle trades at the lowest MC/Rev ratio amongst all of them.

Team

Shuffle’s team is fully doxxed:

Cofounder: Noah Dummett, ex-Alameda (pre-collapse in 2019-2021), ex-BitMex

Head Partnerships: Calum, prev. Co-Founder of Cardigan: livestreamer management w 1bn monthly views;

Incubated by Fisher8 - @hedgedhog on CT, great reputation and incredibly high integrity

It’s worth mentioning that my high levels of conviction directly correlate to how well I know the Fisher8 team - they are a stellar group of individuals, and have known to be one of the most upstanding people in the industry. A big portion of why I believe Shuffle to be the most promising crypto project is precisely because of them - the best talent in crypto incubating a product is something I can very much get behind.

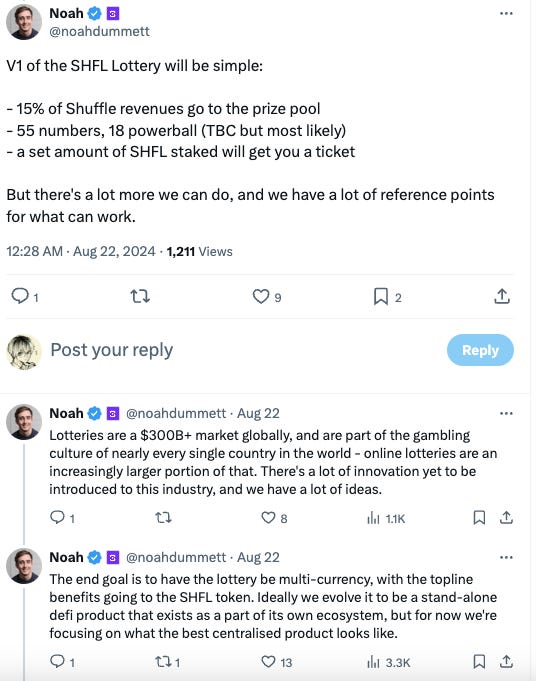

While I don’t know Noah personally, Noah has also shown to be a very outspoken individual on Twitter. This is purely anecdotal and has no data evidence at all, but I generally have better vibes from founders who tweet directly from their personal accounts instead of their company accounts - see Sam Altman’s OpenAI updates, or Elon Musk’s SpaceX updates. Noah does just that, and it signals a sense of transparency that most crypto projects lack.

I think this aspect cannot be discredited, because a big part of the Rollbit saga was their shady / not-doxxed team which led to general disbelief about whether they were legit. The Shuffle team show that they’re doing the opposite, building genuine connections with their community.

Another small point to raise is that their token has given them access to a separate community - because gambling communities have such high churn, it’s tricky to build a strong and steadfast one. However, users can now rally behind their token, giving them access to a much larger user-base than a traditional casino-only product.

Tokenomics

Total Supply / Max Supply: 1,000,000,000

Initial Circulating Supply: 71,126,984.56

Token Breakdown:

31.2% treasury (312,000,000)

fund partnerships / sponsorships, host giveaways

can be used to backstop bets if necessary ;

Ultimate goal of distributing unallocated tokens to users through additional incentive programs and bonusing.

28.0% Airdrops (280,000,000)

All ADs under go a 3m linear vest

25.0% Team (250,000,000)

6m cliff, 36m linear vesting

8.8% Early Contributors (88,000,000)

6m cliff, 36m linear vesting

5.0% LBP (50,000,000)

LBP used to create initial liquidity, w the USDC raised from LBP used to seed initial liquidity for SHFL-USDC pool

46,849,322.43 to the SHFL LP, with 3,150,677.57 returned

2.0% Liquidity Mining (20,000,000)

liquidity to the SHFL-USDC pool

Over a period of 3 years, with 128,205.13 SHFL a week

Lots of words, I know. I’ll try to simplify it to the key points:

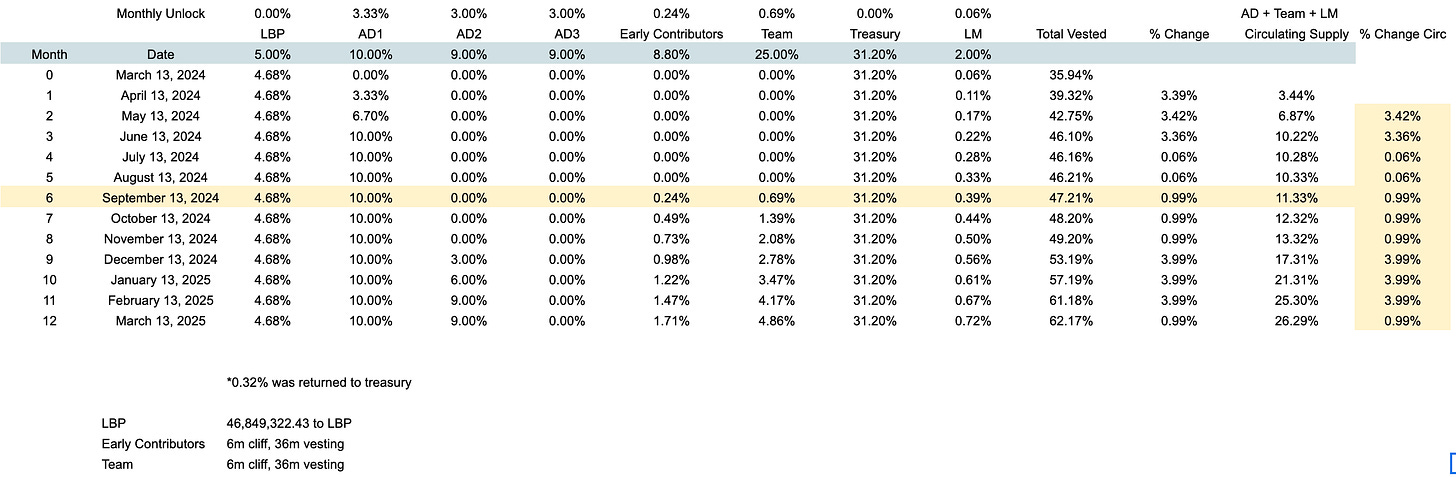

If you check above, the “true circulating supply” on the Shuffle dashboard shows 5.77%, whereas my calculations show an estimated 12.32% that should be unlocked right now; This differential is probably because of the amount burnt (3.58%), and a large percentage of AD1 that has been wagered in SHFL ; Also, I could possibly be wrong in how I calculate it

The important takeaway here is the inflation rate - the team, by my estimates, get an unlock of about 1.0% of total supply each month, until Airdrop 2 (AD2) in December - which is around 3% each month for 3 months

However, the pushback on this is that:

Early investors / team gives off the impression that they’re not willing to dump so early & have high conviction in their product - i.e low chance of “team dumping”

As Shuffle continues to grow, it is quite possible that their buybacks offset the increase in token supply every month

TLDR: Low circulating + Team not really dumping tokens + not a liq farming token = token has low inflation, great utility

Catalysts:

The catalysts for Shuffle are simple - Lottery, and Airdrop 2.

Shuffle Lottery: Shuffle is launching a lottery system that aims to distribute revenue to users, with each Shuffle token representing a ticket in the lottery. This aims to attract more users to buy $SHFL - very bullish

Airdrop 2 - Airdrop 2 aims to airdrop the next 9% of tokens over 3 months somewhere in December to the most loyal users of their platform. While initially bearish (because it’s a large chunk of token supply), I’m of the opinion that it’ll have little to no market impact, because AD2 is weighted to go to users who have used their platform the most. For example, if you withdrew SHFL after AD1, your AD will be less than someone who kept SHFL. Additionally, wagering with old accounts that you’ve been using since AD1 deters sybilling, and also ensures that only the most loyal of users get AD2

While the catalysts aren’t anywhere near “CEX listing” kind of extraordinary, I believe Shuffle is more of a long-term play than a short-term catalyst trade.

Technicals

Alot of people like to tell me that “GambleFi isn’t sexy right now”. My answer to that is: I want to SELL when people think it’s sexy, not buy. Look at Banana, for example. Everyone thought TG bots were dead, and then Banana came back from the dead to prove them all wrong.

The Shuffle chart just looks like a bottomed chart, with not much going on. Perfect for accumulation!

Risks

I know, I know. This article has been very long - and we’re almost at the finish line! Before I end, I’d like to go through the risks of the trade - something very real that we all have to keep in mind.

Risk 1: Why not Rollbit?

Why Shuffle over Rollbit? Rollbit theoretically trades at a cheaper FDV, with “larger BB&B revenues” if you were to believe their numbers. Well, my reasoning against Rollbit is precisely that - it’s hard to trust their numbers. Again, a large part of my conviction in this thesis really lies in the Shuffle team - they have demonstrated to be a strong and trasparent team.

Reputation risk is very real when it comes to businesses like casinos - just like how you wouldn’t trade on shady centralised exchanges, users won’t trust their money with casinos that don’t look entirely clean.

Risk 2: Regulatory Risk

I’m not sure what the legal rules are around a casino having a token; As one can expect, this will also probably not get listed on CEXes. There’s very real regulatory risk around Shuffle, and it’s pretty clear that they might face some tough headwinds from government bodies if they continue to grow.

Regulatory risk is something that can’t be avoided with many crypto products, though. But with casinos, the risk is larger than most - especially if they become one of the biggest casinos in the world. This is why trust in the team is important - having a strong team to navigate uncertain waters is crucial in building a great product.

Risk 3: No immediate catalysts

The catalysts for Shuffle don’t strike me as “huge catalysts” - but that’s ok. To me, Shuffle ticks the boxes of being a long-term investment, not a short-term one. I believe in Shuffle’s continued growth, and eventually, enough people will look at it - similar to what happened to Banana, basically.

Risk 4: Fake Revs

This is a little hard to disprove, but I’m sure it can be easily done by looking at who’s selling SHFL. If you don’t remember, Rollbit was under controversy because people thought the team was selling RLB to fund their buyback and burn - as such, I’m sure it’s possible to check sells on SHFL. While I looked into it, I haven’t done any comprehensive analysis on it.

Concluding Thoughts

We like the purple coin. Shuffle has shown incredible growth thus far, and I’m excited to see where they go next. Building a casino is extremely difficult, but done well, they’re a multi-billion dollar business yearly.

With the clear increasing financialization of the world (prediction markets suddenly exploding in popularity in 2024), it’s clear that online-gambling is on an uptrend. I’m even seeing gambling reels on Instagram, and gambling influencers are going viral for hitting “huge wins”. I believe Shuffle is well-positioned to capture the rise in gambling, and is poised to see increased growth in the coming months.

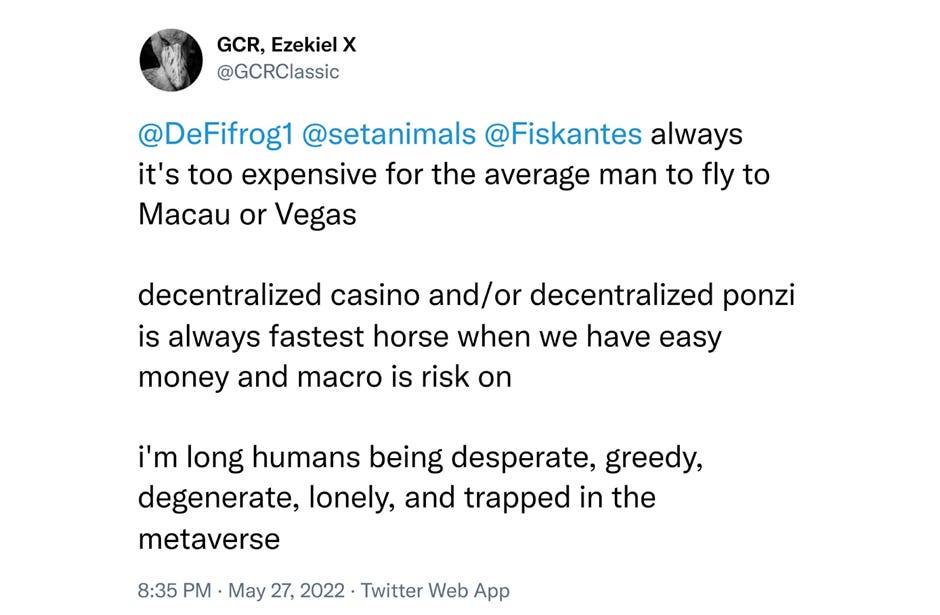

As GCR likes to say:

Thanks for reading! <3, Kyle

•

•

•

Affiliate Disclosures

- The author and/or others the author advises do not currently hold, or plan to initiate, an investment position in target.

- The author does not hold an affiliated position with the target such as employment, directorship, or consultancy.

- The author is not being compensated in any form by the target in relation to this research.

- To the best of the author’s knowledge, the information provided here contains no material, non-public information. The accuracy of the information is the responsibility of the reader.

Neither BIDCLUB nor PHATPITCH LLC represents or endorses the accuracy or reliability of any advice, opinion, statement or other information displayed, uploaded, or distributed through BIDCLUB by any user, information provider, or other party. PHATPITCH LLC is not a broker, a dealer, or investment adviser. Nothing in BIDCLUB constitutes an offer or a solicitation to buy or sell any securities. BIDCLUB prohibits the sharing of material non-public information (MNPI), but assumes no responsibility for member conduct or associated risks. Nothing in BIDCLUB is intended as specific investment advice and no individual should make any investment decision based on any recommendation or analysis provided on BIDCLUB. You acknowledge that any reliance upon any such opinion, advice, statement, memorandum, or information shall be at your sole risk, and you bear sole responsibility for your own research and investment decisions. See full

Terms and Conditions.

“And if you want to argue that the sharp jump in volume was “because of the airdrop” - post Airdrop 1 (AD1) we still saw continued growth; They didn’t have the usual post-airdrop dump in volumes”

There are a total of three airdrop seasons. Not just one. I’d argue that much of this is still incentivised volume and the burden of proof is on the team.

Secondly, the token has already 1.7-1.8xd its supply between just this week driven literally by the cliff which much of CT hasn’t commented on. This gets worse with airdrop 2 and 3 linearly vesting and the continuous insider vesting (third of supply) starting literally now. Thus I’d argue definitely look at fdv/revs, tying this to point one, much of that revenue is incentivised and how sticky that is incredibly difficult to define.

Thirdly the organised shill campaign is particularly concerning given the step change in supply this quarter driven entirely by team and early contributors which leaves a poor taste, although I would say I have no evidence and maybe everyone suddenly just discovered this was undervalued and worth bidding(?).

Finally, an airdrop and a supply unlock isn’t really a catalyst. Overall, I think it is a great trade thesis, not quite one to hold as an “investment” however given the above. At the very least I’d like to see what the team do now with their tokens along with early contributors (instead of just hoping they’d not sell as your article suggests), and monitor the slightly less incentivised post-airdrop revenues (please see current blur bid liquidity thickness for what happens when free money faucet runs out).

P.S. no hate love the Fisher8 team and hog is an outstanding trader. I also like what Noah is doing and wish them all the best ❤️