Ethena

ENA

Target Name

Ethena

Ticker

ENA

Strategy

long

Position Type

token

Current Price (USD)

0.4

Circulating Market Cap ($M)

1,096

Fully Diluted Market Cap ($M)

5,983

CoinGecko

Ethena: The Trillion Dollar Crypto Opportunity

17 Oct 2024, 12:11am

The TLDR

Ethena is the fastest growing DeFi product in history. Scaling its yield-bearing stablecoin to $3bn in a matter of months, no other stablecoin has grown as quickly as USDe since inception. Chapter one of Ethena’s story has been focused on building a superior stablecoin that is safe. Having withstood the test of extreme market volatility with no issues, it now looks to go after the biggest prize in all of crypto - Tether's $160b lunch. This is where Ethena begins to transition from a “DeFi native stablecoin” into a legitimate stablecoin contender with a superior value proposition and drastically improving distribution channels. The introduction of USTb, latest involvement of Blackrock’s treasury products and falling interest rates, have resulted in the stars aligning for Ethena and it is now in pole position to make USDe the dominant stablecoin in crypto.

Due to a myriad of market inefficiencies, you now have the chance to buy the strongest upcoming contender in the biggest vertical in crypto, at 1/4

$WIF's market cap.

The Existing Meta

This cycle has been dominated by memecoins. The market has recognized the rigged game of buying tokens for relatively unproven VC projects listing at egregious valuations, multiples higher than most VCs cost bases. Instead, we have fully embraced the more free-for-all game of memecoins. The continual outperformance of memecoins over other alts has led to what some deem as “financial nihilism” - a disregard for all fundamentals in pursuit of narratives. While this was the most profitable trade of the past 2 years in crypto, it has become more commonplace and has even led to an ATH attention in memecoins.

Mindshare for memes across crypto has hit an ATH | Source: Kaito

As the market becomes intoxicated with memecoins, it has slowly forgot a timeless lesson taught across all markets:

The strongest speculation is always founded in at least a kernel of truth

The rise in memecoins has been primarily a crypto-native, retail-led market phenomenon. What these retail participants forget is that the most exorbitant liquid performers over time have always been founded in some parabolic growth on a fundamental level. This is because it is only with fundamental anchors can a schelling point for all pools of crypto-native capital (retail, hedge funds, prop funds, long-only liquid funds) appear. This is $SOL’s story in a nutshell this cycle, where those who were paying attention to developer engagement in early 2023 were able to form a fundamental thesis for Solana ecosystem’s growth and subsequently enjoy the almost 10x rerating within a year.

You may also recall Axie Infinity's liquid 500x and the millions of players they onboarded at the peak of the euphoria. Another all too familiar reference would be Luna's $40bn in UST that was circulating globally and the resultant 1000x you could've achieved in 18 months (assuming you bought $LUNA from the lows and correctly underwrote the spiral risk to get out in time).

Whilst financial nihilism is an overarching trend that has dominated this cycle, one may posit that it is a lack of strong PMF for this current vintage of VC projects that has led to this perverse consensus view.

All it takes however is for one project to allow the masses to dream again.

I believe Ethena is the strongest candidate to take that spot this cycle.

The Basics

When thinking about stablecoins, there are only really two things that matter.

Value proposition - Why should you hold this?

Ethena's product and value proposition is pretty simple. Deposit $1, receive a delta neutral position split between staked ETH and an ETH short position, and earn yield. Assuming normalized funding rates, sUSDe offers the highest sustainable yields on any stablecoin today (10-13% APY). This material value proposition has translated into Ethena becoming the fastest growing stablecoin in history, reaching a peak of $3.7b in TVL within a span of 7 months, and now stabilizing at $2.5b after funding rates have dropped.

USDe significantly outclasses every other DeFi product in terms of yield generation

At a glance, it is clear that sUSDe is the undisputed king of yield across all of crypto. Why would you hold Tether today and give up ALL of the possible yield on your dollar? Chances are it's because its the most easily accessible and the most liquid. That brings us to...

2. Distribution - How easy is it to obtain this and use it as a form of currency?

When bootstrapping any new stablecoin, distribution channels are by far the most important factor in determining adoption. USDT is the #1 stablecoin today because it is the base currency for any market on every Centralised Exchange. This in itself is a huge moat, and it will take years for newer stablecoins to begin taking market share.

USDe however has managed to do something pretty special. With backing from Bybit, it has become available to users on the 2nd largest CEX with automatic yield bearing capabilities embedded within the platform. This has allowed users to access a superior form of stablecoin collateral, without adding increased friction. To date, no other decentralised stablecoin has been onboarded to any major CEX which goes to show you how difficult this feat is.

Source: Artemis

The current amount of stablecoins sitting on centralized exchanges is approximately $38.6B, 15x of what USDe supply is today. Should even a small 20% of the supply decide that earning 5-10% on USDe is preferable to giving it up, that would represent an almost 4x increase in USDe’s serviceable market from here. Now imagine what happens when all the major CEXs onboard USDe as collateral?

Catalyst 1: Structural decline of interest rates

Since Ethena's inception, the relative yield premia of sUSDe has averaged 5-8% vs the Fed Funds Rate. This structural advantage has seen billions of dollar of yield-seeking capital within crypto flow into Ethena within the first 9 months of launch.

Latest Fed Dot Plot (Sep 2024)

Powell's 50 bps drop of the Fed Funds rate in September signifies the beginning of an extended decline in risk free rates globally. Dot plots currently estimate a steady state Fed Funds rate of 3 - 3.5%, implying a ~2% decrease in rates over the next 24 months. This however, has nothing to do with Ethena's source of yield and in fact can be argued that there are positive indirect trickle down effects on funding rates (markets go up -> risk returns -> demand for leverage increases -> funding rates goes up).

When combined together, this potent mix is what sends spreads sky high and is the true value proposition of Ethena's product.

USDe supply is extremely sensitive to yield spreads wrt Treasuries

Referencing the two charts above, it is obvious that appetite for USDe is highly sensitive to the yield premium against US treasuries. During the first 6 months of elevated yield premia, USDe supply shot through the roof. As the premia decreased, demand for USDe naturally petered off as well. With this historical data, I am confident that a return of the yield premium would result in a re-accelaration of USDe growth. Importantly, this tailwind is both easily understandable and attractive to most market participants.

Over time, I expect that this will significantly improve Ethena's mindshare within the market, similar to how Luna and UST dominated the field in 2021 when DeFi yields began declining and UST's 20% guarantee in Anchor became more and more popular.

Catalyst 2: USTb

USTb was first introduced two weeks ago and in my opinion, is an absolute gamechanger that can supercharge USDe adoption.

The TLDR of USTb is as follows:

100% backed stablecoin by Blackrock and Securitize

Functions exactly the same as other stablecoins sourcing yield from Treasury Bills without added custodian / counterparty risks

Can become a subset of USDe such that sUSDe holders obtain Treasury yields in the event that Tradfi yields > crypto yields

The market is under-appreciating this because there is now literally zero reason to hold any other stablecoin in crypto aside from USDe after this assuming you are comfortable with exchanges like Binance not blowing up (even if they do, USDe does not go to zero as it is fully collateralized by BTC & stETH). At the worst, you get yields similar to your competitors, and if not you're paid yield based on the risk appetite of the market.

By incorporating USTb in the backend, yield volatility for sUSDe is now significantly smoothened, putting to rest the biggest fud point about Ethena not having sustainable yields in a bear market. Lowered yield volatility also increases the chance of future CEX integrations down the road.

With these two catalysts, Ethena has an all-encompassing superior stablecoin that dominates every other competitor today.

Tokenomics: The Good, The Bad, and The Opportunity

One of the banes of VC coins is that if you hold the coins long enough, you naturally become exit liquidity for early investors, team and other stakeholders who have been rewarded tokens. This point alone has led the entire market to completely write off the biggest product-market fit crypto has seen this cycle in favor of pure memecoins.

Ethena is no different from your usual VC coin. Since the highs, $ENA has dropped ~80% on the back of elevated launch valuations and incoming airdrop supplies hitting the market. Over these 6 months, Season 1 farmers have completely unlocked and 750m tokens have hit the market. These unlocks coupled with a decrease in demand for leverage ultimately crushed the narrative for $ENA and is the reason why nobody owns this coin today and why I strongly suspect re-ratings up will be violent.

So why should you touch this evil VC coin now? The answer is simple - for the next 6 months, a drastically reduced $ amount of $ENA will be hitting the market, significantly dampening sell pressure. Yesterday the first batch of tokens were released and out of a total of $125m of added supply, farmers have only claimed $30m, opting to lock the rest of their tokens up. Given that farmers have been the predominant marginal seller for the past few months, what happens when they stop selling? Prices have already found a natural floor at 20c and now forming a HL at 26c.

Between now and Apr 2025, the only additional inflation would be the residual ~300m in farmer rewards coming to market but at 28c this comes down to ~$450k in daily unlocks (less than 1% of daily volume). To put this into perspective, $TAO has gone up 250% in the past month despite having inflation pressures of $4-5m dail. The point here is, when stars align inflation unlocks rarely matter in re-rating coins upwards. After Apr 2025, the team / VCs begin unlocking, and so this gives us ~6 months for the thesis above to play out.

How Big is the Dream?

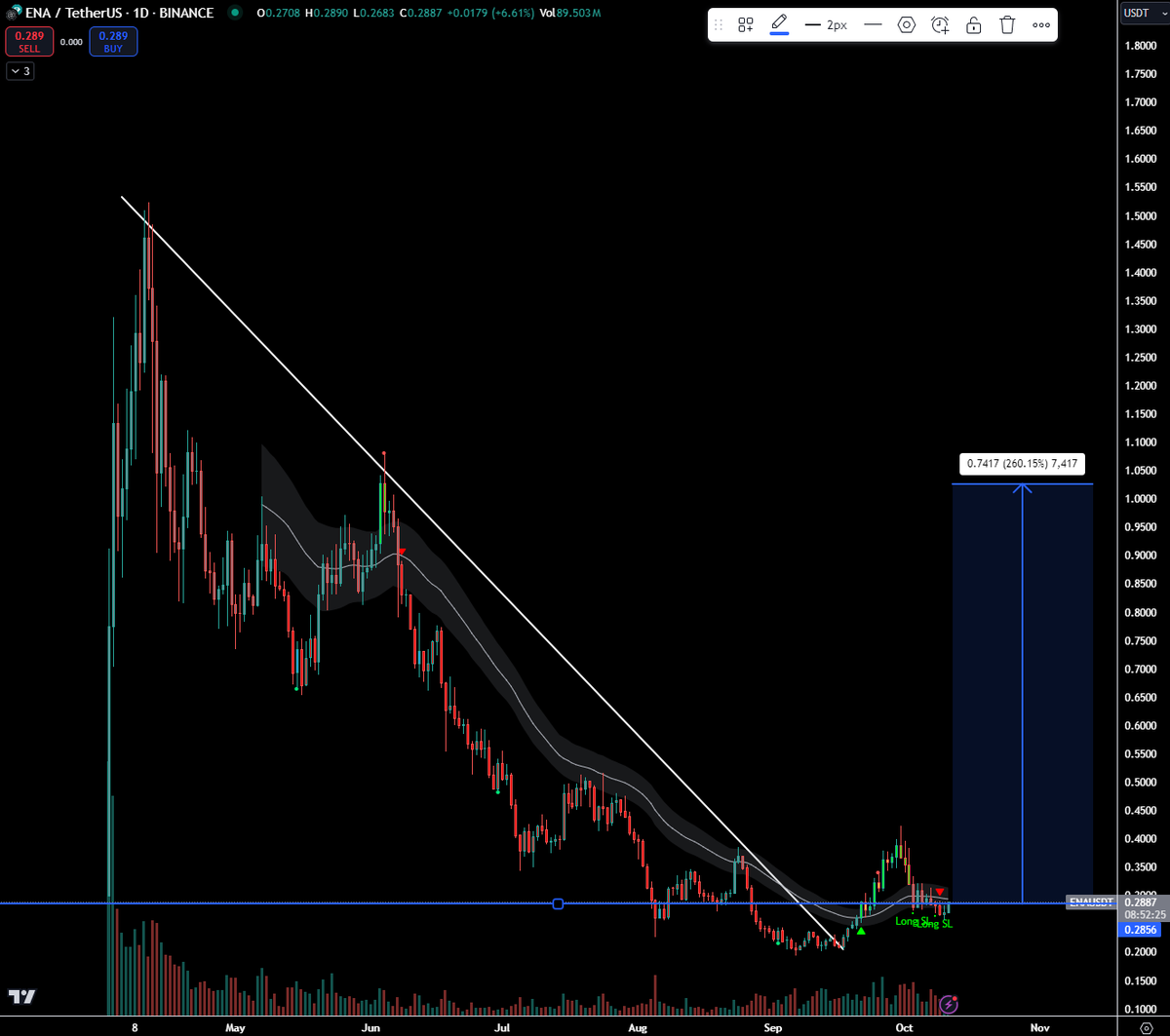

Despite being the only major new product with clear PMF this cycle, $ENA isn't even trading in the top 100 on Coingecko. From a TA perspective the HTF chart of ENA looks extremely clean. Adding fundamental drivers + reduced inflation pressure, I can easily foresee $ENA reclaiming the $1 level. This wouldn't even put $ENA on par with $WIF in market cap terms, and would only match $POPCAT's recent highs of $1.5b circulating supply.

Looking further, Ethena has the foundation to scale USDe into the tens and then hundreds of billions of dollars. Eventually as crypto stablecoins gain further marketshare due to international cross-border payments, a trillion dollars is not out of the question. At this point I would be surprised if $ENA isn't a top 20 coin given how its the best product going after the largest market in crypto.

When we get there is anybody's guess, but Ethena is my bet on the next big dream for crypto this cycle.

---

As always, nothing above should be construed as financial advice, pls DYOR.

I am obviously also long this token but may change positioning if further data impedes the thesis above.

•

•

•

Affiliate Disclosures

- The author and/or others the author advises do not currently hold, or plan to initiate, an investment position in target.

- The author does not hold an affiliated position with the target such as employment, directorship, or consultancy.

- The author is not being compensated in any form by the target in relation to this research.

- To the best of the author’s knowledge, the information provided here contains no material, non-public information. The accuracy of the information is the responsibility of the reader.

Neither BIDCLUB nor PHATPITCH LLC represents or endorses the accuracy or reliability of any advice, opinion, statement or other information displayed, uploaded, or distributed through BIDCLUB by any user, information provider, or other party. PHATPITCH LLC is not a broker, a dealer, or investment adviser. Nothing in BIDCLUB constitutes an offer or a solicitation to buy or sell any securities. BIDCLUB prohibits the sharing of material non-public information (MNPI), but assumes no responsibility for member conduct or associated risks. Nothing in BIDCLUB is intended as specific investment advice and no individual should make any investment decision based on any recommendation or analysis provided on BIDCLUB. You acknowledge that any reliance upon any such opinion, advice, statement, memorandum, or information shall be at your sole risk, and you bear sole responsibility for your own research and investment decisions. See full

Terms and Conditions.

Hey ENAS, in your view, will $ENA face a uniswap-like situation where all yields go towards incentivising the supply side (i.e. sUSDE holders) with none left for $ENA value acrrual?