Chainflip

FLIP

Target Name

Chainflip

Ticker

FLIP

Strategy

long

Position Type

token

Current Price (USD)

1.26

Circulating Market Cap ($M)

46.6

Fully Diluted Market Cap ($M)

121

CoinGecko

$FLIP - Disrupting Thorchain's Native BTC Dominance

31 Oct 2024, 08:21am

Summary:

FLIP’s cross-chain’s swap volumes have ~3x (from $2.75M to the current $8.5M daily avg) since launching “DCA swaps” on Oct 8th, 2024.

Growth stems from FLIP's frontend only, with aggregator integration pending - representing significant untapped volume potential (around >$7M net new orderflow).

With an average total take rate on cross-chain swap volume of 0.177% (.1% from the network fixed fee, .05% from L14Ds average LP Fee, and .027% from L14Ds average Broker Fee) and at current FDV of $120M, FLIP is trading at a ~30x vs Thorchain at a ~70x FDV / Fees.

Base/bull case targets: 5-10x upside, predicated on: a) cross-chain swap volumes returning to prev ATH levels, b) FLIP capturing a modest share from Thorchain, c) Multiple naturally convergingback to its main comp, Thorchain, driven by more coverage of recent volume growth.

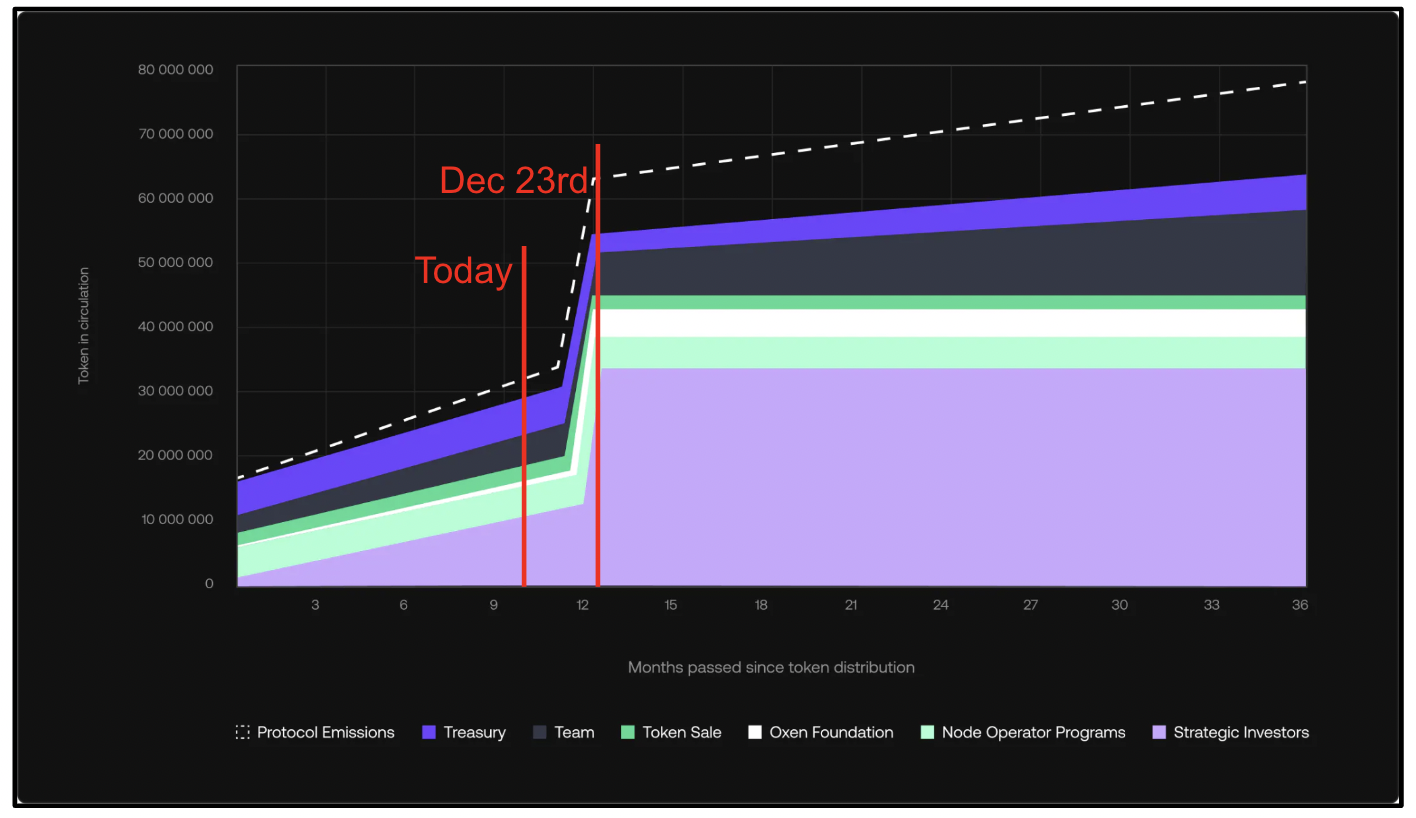

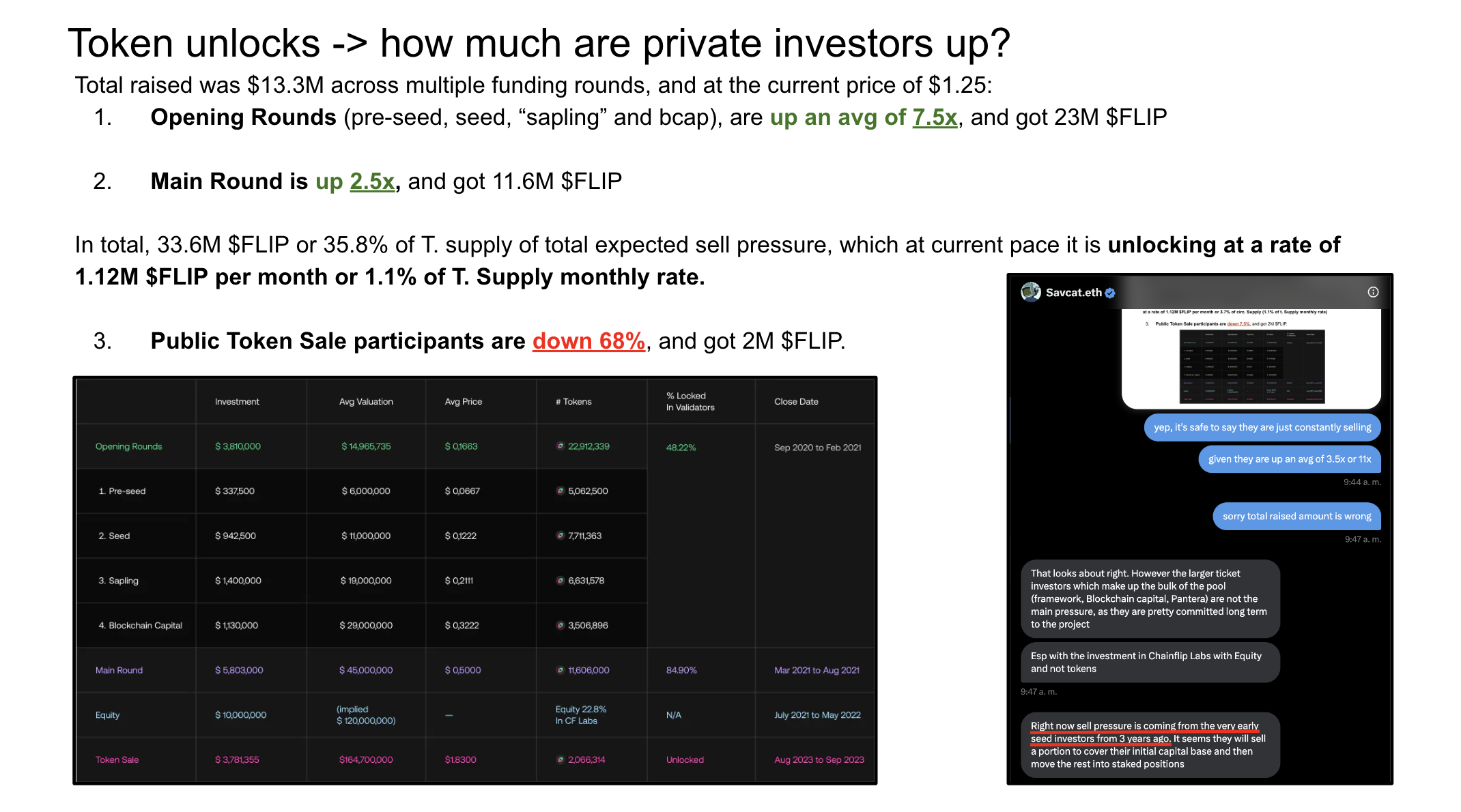

Key risk: Dec 23rd token unlock increasing float from 40% to >70%.

Investment Thesis

Volumes have 3x since the introduction of “DCA swaps”, which makes FLIP competitive on larger USD orders

FLIP's cross-chain swap volumes have tripled following the introduction of Dollar-Cost Averaging (DCA) swaps:

Pre-DCA: $2.75M daily average

Post-DCA: $8.5M daily average

The DCA functionality, comparable to Thorchain's streaming swaps, optimizes large-order execution by automatically splitting transactions into smaller tranches. This method:

Reduces price impact

Minimizes slippage on high-value trades

Enhances FLIP's competitiveness in the large-order segment of the market

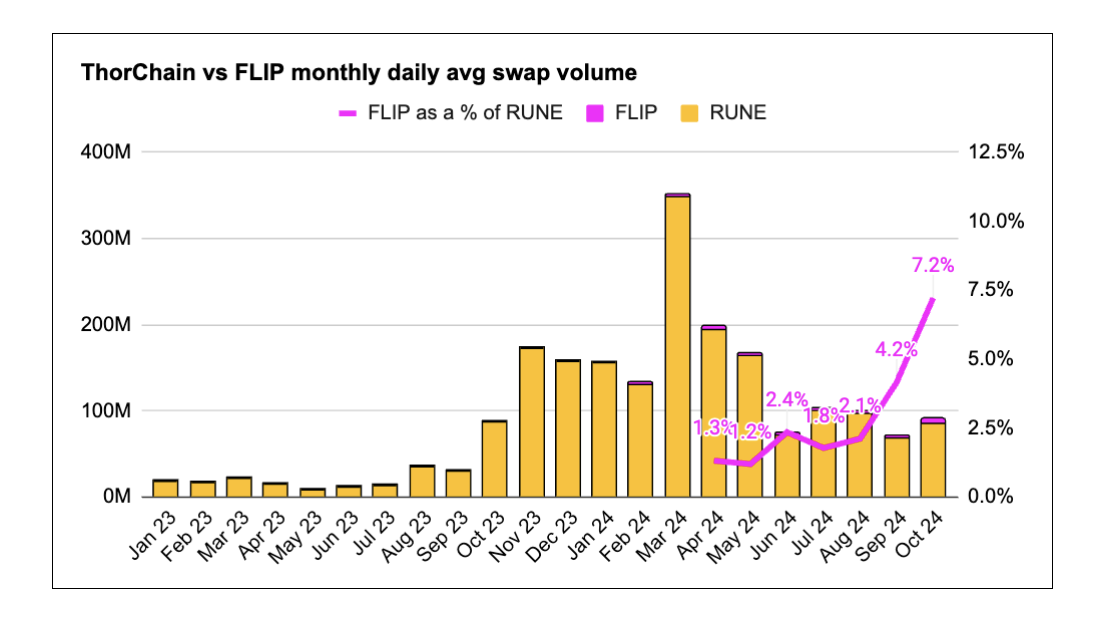

The implementation has proven particularly effective for larger-amount transactions, marking FLIP's strategic push into the high-value order flow market, which was previously dominated by ThorChain. As a result, ChainFlip’s swap volume as a % of ThorChain’s has gone from 2% to 7.2%, and there is a clear path to comfortably reach 10-15% before the EOY.

https://scan.chainflip.io/swaps?page=1&limit=20

The next wave of growth should come from aggregators, which would enable FLIP’s access to >$7M net new orderflow. This is expected to go live in the coming weeks.

The short-term growth opportunity lies in pending aggregator integrations, potentially generating >$7M in additional daily orderflow. ThorSwap, the leading native BTC<>EVM swap frontend aggregator, processes $7-12M in daily volume. ChainFlip previously captured 10-15% of ThorSwap's volume, primarily limited by competitiveness in large-order execution. With DCA implementation and enhanced features (advanced rebalancing, increased LP liquidity), ChainFlip is positioned to potentially capture >50% of ThorSwap's market, translating to $4.5-6M in new daily orderflow.

https://app.thorswap.finance/swap

https://app.thoryield.com/volume

FLIP’s take rates are competitive and BTC native swaps is a big enough market

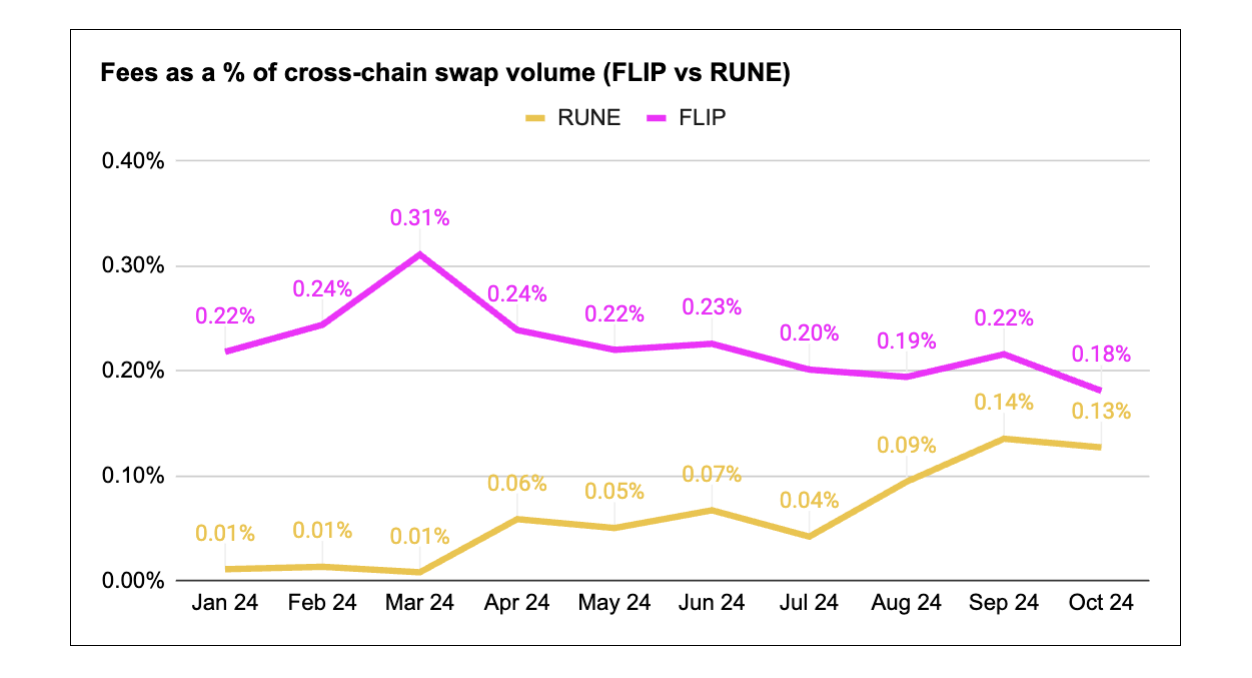

ChainFlip maintains a competitive total take rate of 0.177%, comprising of:

0.1% network fixed fee, which gets redirected to BBB $FLIP

0.05% average LP Fee (L14D)

0.027% average Broker Fee (L14D)

This rate has optimized from 0.31% in March 2024, with further improvements expected through:

Advanced rebalancing implementation

Increased liquidity attraction via competitive BTC yield APRs

The rate structure positions FLIP favorably against alternatives:

Solana wrapped BTC protocols: 0.15% for BTC to USD/ETH swaps

CEX operations: ~0.1% + >30-minute processing time

Decentralized options: Thorchain (0.13-0.14%), Maya Protocol (0.2-0.3%)

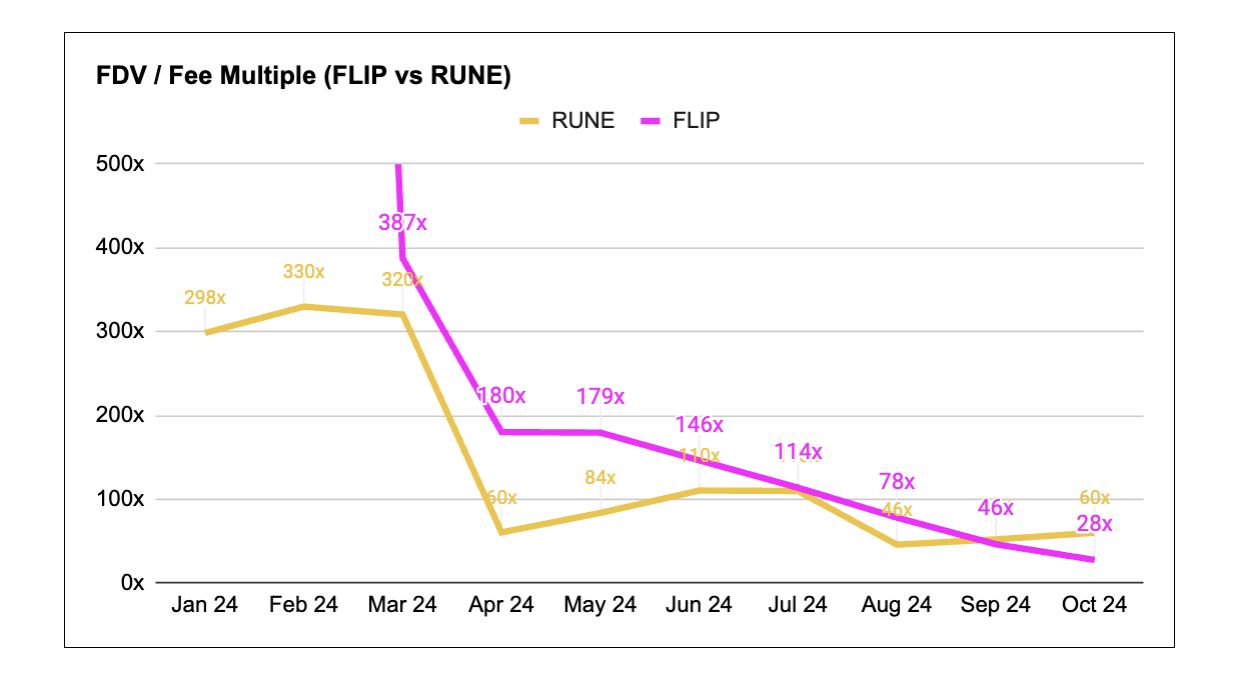

FLIP didn’t look attractive previously as it was trading very expensive relative to $RUNE’s FDV/Fees + had constant vesting unlocks, but current 25-30x FDV/Fees and $120M FDV should be a decent entry

Upside on the base case is 5x and 10x in the bull case

Key assumptions:

Native BTC cross-chain swap volumes returning to near-ATH levels (which happened on March 2024 with $350M daily average):

Base: $200M daily average

Bull: $300M daily average

FLIP captures a modest share from Thorchain, driven by aggregators integration (ThorSwap in the short term, and LIFI and Squid, other generalized aggregators, in the long-term) and goes from the current 7% to:

Base: 10%

Bull 15%

FDV/Fees Multiple to naturally converge to its main comp, Thorchain, driven by more coverage of the volume growth and share penetration dynamics + (naturally from the buyback).

Main risk are token unlocks, which the biggest one being the upcoming one on Dec 23rd, 2024

Appendix

Similar thing happened to Thorchain -FLIP’s main competitor- when they launched their “streaming swaps” on Aug 2023

After Thorchain released its streaming swaps product update their cross-chain swap volume went up 5.5x from doing $10M in daily volume to $55M, and since the start of the year they have been averaging around $140M in daily cross-chain swap volume.

•

•

•

Affiliate Disclosures

- The author and/or others the author advises do not currently hold, or plan to initiate, an investment position in target.

- The author does not hold an affiliated position with the target such as employment, directorship, or consultancy.

- The author is not being compensated in any form by the target in relation to this research.

- To the best of the author’s knowledge, the information provided here contains no material, non-public information. The accuracy of the information is the responsibility of the reader.

Neither BIDCLUB nor PHATPITCH LLC represents or endorses the accuracy or reliability of any advice, opinion, statement or other information displayed, uploaded, or distributed through BIDCLUB by any user, information provider, or other party. PHATPITCH LLC is not a broker, a dealer, or investment adviser. Nothing in BIDCLUB constitutes an offer or a solicitation to buy or sell any securities. BIDCLUB prohibits the sharing of material non-public information (MNPI), but assumes no responsibility for member conduct or associated risks. Nothing in BIDCLUB is intended as specific investment advice and no individual should make any investment decision based on any recommendation or analysis provided on BIDCLUB. You acknowledge that any reliance upon any such opinion, advice, statement, memorandum, or information shall be at your sole risk, and you bear sole responsibility for your own research and investment decisions. See full

Terms and Conditions.

2 updates:

- Actual big unlock hapens on Nov 22nd, not Dec 22nd.

- Good deep-dive into how ChainFlip works from a technical perspective -> https://www.decentralised.co/p/bitcoin-superconductor