Hyperliquid

HYPE

Target Name

Hyperliquid

Ticker

HYPE

Strategy

long

Position Type

token

Current Price (USD)

40

Circulating Market Cap ($M)

13,400

Fully Diluted Market Cap ($M)

40,000

CoinGecko

Hyperliquid: The onchain house of finance

11 Jun 2025, 04:31am

The $HYPE TGE was one of the most successful TGEs in recent history, launching at around $2.5 in November 2024 and reaching an ATH near $40 in May 2025. While this massively successful price action has led many to question if it is still a good investment at current valuations, I believe Hyperliquid’s potential surpasses that of Solana, BSC, and in the long term even Ethereum. In this article, I will offer a detailed analysis of Hyperliquid’s growth metrics and unique features which are easily overlooked, explaining why Hyperliquid is still undervalued for the immense growth potential it has.

1. A true CEX competitor

Hyperliquid has completely dominated the perp dex space, making up almost 80% of all perp dex volume. Other perp dexes are simply too far behind, struggling with illiquid orderbooks, limited asset selection, lack of advanced order types and latency issues. While Hyperliquid experienced some of these issues in its early stages, they were quickly fixed and Hyperliquid has been dominating ever since.

Hyperliquid’s main competitors at this stage are Tier 1 CEXes, such as Binance, Bybit, and OKX. Against these competitors, Hyperliquid has been steadily increasing in both volume and OI since the HYPE TGE. While metrics have not quite caught up to Binance, they are steadily increasing and now pose a serious threat to Tier 1 CEX dominance. This was made evident during the HLP exploit in March 2025. While HLP was overexposed to a $JELLY short position, Binance and OKX both listed $JELLY on futures, attempting to incur severe losses to HLP.

2. The Assistance Fund - direct value accrual to HYPE

Currently, 93% of perp trading fees from Hyperliquid go to the Assistance Fund, which buys $HYPE on the open market. The remaining 7% go to HLP. The Assistance Fund currently holds 7.25% of the circulating supply. This allows revenue from the exchange to accrue directly to HYPE holders. While almost all crypto projects have zero value accrual to the token (no one is buying tokens for governance purposes), the Assistance Fund provides a floor for HYPE by being a price-insensitive buyer.

On the spot side, fees paid in USDC when selling a spot asset (i.e. 50% of total fees) also go to the Assistance Fund. Fees paid in the spot token (eg. BTC, ETH, SOL) can be burnt or given to the spot token deployer. Hyperunit, the deployer of spot BTC, ETH, SOL and FART, is currently using the fees accrued from its spot token listings to buy HYPE, acting as a secondary assistance fund.

Over the past 30 days, Hyperliquid accrued $64.3 million in revenue to token holders, giving an annualised revenue of $784 million. This makes it the highest revenue generating project in crypto (only counting revenue accrued to token holders, which excludes stablecoin issuers like Tether and Circle).

Currently, Hyperliquid does not offer the ability to use spot assets such as BTC or HYPE as margin instead of only USDC. However, this functionality can be built by external protocols using precompiles or through HIP-3 if the perp deployer chooses to accept non-USDC collateral (more on precompiles and HIP-3 later). Coin-margined perps on Hyperliquid could draw even more volume to the exchange, further increasing revenue.

3. Spot growth potential

To be listed on the Hyperliquid spot market, token deployers must first purchase the ticker using HYPE in a ticker auction based on the Dutch auction system. This means that spot tickers are a finite, valuable resource, and spot deployers contribute to HYPE buying pressure.

Spot trading fees are also much lower on Hyperliquid than on Tier 1 CEXes, irrespective of fee tiers, with taker/maker starting at 7bps/4bps on Hyperliquid vs 7.5bps/7.5bps on Binance (paid in BNB). If Hyperliquid’s spot market continues growing, Hyperliquid could eventually increase the fees to match Binance, increasing revenue from spot trading by almost 50%.

4. HyperCore + HyperEVM synergy through precompiles

This is a very big one - no other blockchain is as well-equipped to be the onchain house of finance as Hyperliquid is with its unique design. Hyperliquid can be broken down into 2 parts: HyperCore and HyperEVM.

HyperCore consists of performant native components: perp and spot orderbooks, staking, oracles, multi-sig, etc. HyperEVM is a general purpose world-computer, allowing builders to deploy code that interacts with both HyperEVM and HyperCore. Together they form one composable state secured by HyperBFT consensus (i.e. no need for bridging, proofs, or trusted signers, in contrast to the Ethereum ecosystem).

Precompiles allow the HyperEVM to read from and write to HyperCore, unlocking a wide range of possibilities that are impossible to do on other blockchains. Some possibilities include:

Lending markets that liquidate directly into the spot order book

The protocol could automatically hedge borrower collateral using perps if prices move too much (self-liquidating loans).

The protocol could offer higher LTV ratios through hedging exposure to the users’ collateral.

Options and exotic derivatives

Automatic hedging for options to offer deeper liquidity tapping into the perps order book.

More complex financial products (e.g., covered calls, straddles).

Yield protocols that automate trading strategies

Vaults that dynamically hedge against HyperEVM positions or long/short perp contracts based on live market data

A tokenized HLP vault and other structured products

There are a few protocols on HyperEVM intending to build tokenised HLP, such as Hyperdrive and Hyperlend

Tokenised HLP could be used as collateral and looped, similar to JLP/USDC loops in Solana

Liquid staking protocols

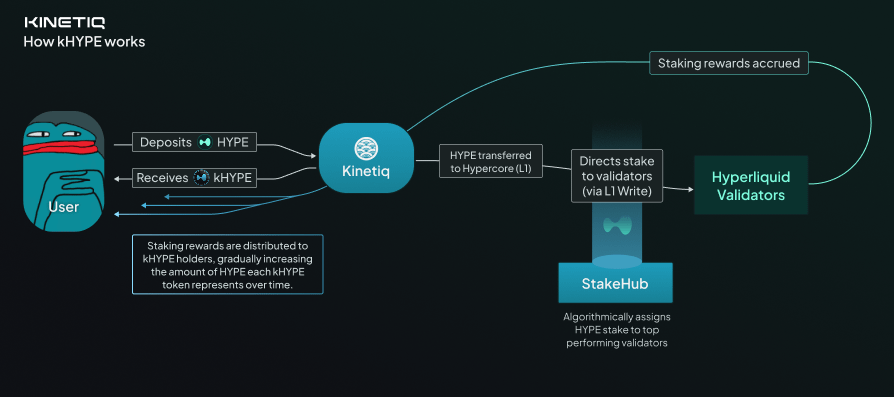

Kinetiq, the most anticipated liquid staking protocol on Hyperliquid, will use write precompiles to direct HYPE staking on HyperEVM to validators on HyperCore

5. Builder codes

Builder codes allow builders to receive a fee on trades that they send on behalf of a user. Builder codes currently only apply to fees collected in USDC (i.e. builder codes do not apply to the buying side of spot trades). The maximum builder fee is 0.1% on perps and 1% on spot.

Through builder codes, builders can easily access Hyperliquid’s deep liquidity for free, so they can focus on delivering unique user experiences without having to source their own liquidity. Builder codes enable Hyperliquid to become the “AWS of liquidity”, but at no cost to builders.

There have already been many frontends deployed using builder codes, with the most notable being PVP.trade, a telegram bot built for social trading on Hyperliquid. To date, builders have already generated over $9 million in builder fees, and many more applications built using builder codes are actively in development.

Applications that could be built using builder codes include:

Localized frontends that tailor the trading experience to specific regions and languages. This would be similar to Binance’s “Link Program” which allows link clients to deploy region-specific exchanges leveraging Binance liquidity.

Streamlined mobile apps designed for less experienced retail users. These include Lootbase, Dexari, and Defidotapp.

6. Staking referral program

The staking referral program is currently not live on mainnet, but it introduces revolutionary changes that bring the utility of builder codes to the next level.

Under the staking referral program, builders and referrers who stake HYPE will be able to keep a percentage of their referred users’ trading fees, up to a maximum of 40% at the highest staking tier. Additionally, they will be able to share up to 50% of the staking referral revenue back to the referred user. Thus, referrers will be able to offer fees that are even better than default.

I believe this program will bring a new wave of liquidity to Hyperliquid and accrue even more value to $HYPE due to these effects:

More incentive to stake HYPE. KOLs are now highly incentivised to stake HYPE to earn more fees from their referrals, and large scale applications built on builder codes will likely aim for the highest staking tiers to keep the maximum percentage of their referral fees and offer the best fee rates for their users, while still charging a builder fee.

Increased retail participation. If a suitable frontend is developed (eg. a Robinhood-esque trading app built using builder codes, with easy fiat on/off ramping like Moonshot), a huge wave of retail could start using Hyperliquid without even knowing it. With the staking referral program, if the fees are cheaper than default, this could drive huge amounts of volume to the app and capture even more attention from retail.

7. HIP-3

HIP-3, currently live on testnet, allows deployers with at least 1 million staked HYPE to deploy new perp markets on HyperCore. Deployment gas is paid in HYPE through a Dutch auction every 31 hours, similar to the spot listing market. Deployers can configure additional fees on top of the base fee rate, and also set a fee share of up to 50%.

While the 1 million staked HYPE requirement is incredibly high and most deployers would not be able to put up this stake on their own, there are ways to overcome this limitation. A perp deployer could create an LST on HyperEVM, fully composable with HyperCore, and get users to stake into this LST to reach the 1 million HYPE stake requirement. Alternatively, existing LST providers could offer this service, such as stakedHYPE which intends to operate a Hyperliquid Stake Marketplace - a middleman that conducts an auction on the rights to use a certain amount of staked hype.

Through this “crowdfunding” method for HIP-3 deployments, perp deployers would also be obligated to share some of their revenue from fees on their perp market back to the LST users. This would increase HYPE yield to LST holders, incentivising more LST usage and thus increasing the staked proportion of HYPE.

Conclusion

Hyperliquid presents a unique opportunity in the crypto landscape. While most blockchains focused on building a typical blockchain and letting spot and perp DEXes build on top of them, Hyperliquid chose to focus on building spot and perp markets as a core primitive of the blockchain, allowing these markets to be seamlessly integrated into an EVM environment. This unlocks possibilities that are simply impossible on Ethereum, Solana, and other L1s, and I believe Hyperliquid has true potential to become the onchain house of finance.

•

•

•

Affiliate Disclosures

- The author and/or others the author advises currently hold, or plan to initiate, an investment position in target.

- The author does not hold an affiliated position with the target such as employment, directorship, or consultancy.

- The author is not being compensated in any form by the target in relation to this research.

- To the best of the author’s knowledge, the information provided here contains no material, non-public information. The accuracy of the information is the responsibility of the reader.

Neither BIDCLUB nor PHATPITCH LLC represents or endorses the accuracy or reliability of any advice, opinion, statement or other information displayed, uploaded, or distributed through BIDCLUB by any user, information provider, or other party. PHATPITCH LLC is not a broker, a dealer, or investment adviser. Nothing in BIDCLUB constitutes an offer or a solicitation to buy or sell any securities. BIDCLUB prohibits the sharing of material non-public information (MNPI), but assumes no responsibility for member conduct or associated risks. Nothing in BIDCLUB is intended as specific investment advice and no individual should make any investment decision based on any recommendation or analysis provided on BIDCLUB. You acknowledge that any reliance upon any such opinion, advice, statement, memorandum, or information shall be at your sole risk, and you bear sole responsibility for your own research and investment decisions. See full

Terms and Conditions.